Hand writing "Tax Return" on a note placed on a computer keyboard. (Niz art Photodesign/Shutterstock)

Here’s how to use PA’s new free file option, and how to know if you qualify.

File Pennsylvania state income tax returns for free

Pennsylvanians can access Pennsylvania’s free file system by through MyPath, Pennsylvania’s tax and resources hub.

Gov. Josh Shapiro said more than 100,000 Pennsylvanians qualify for the free file service.

Those eligible to use PA’s free file system include:

- Single taxpayers who were full-time residents of Pennsylvania in the prior year

- Taxpayers with only one W-2 income source from the same employer in the prior year

- Taxpayers whose employer has filed the corresponding W-2 with the Department of Revenue

- Taxpayers not claiming deductions, credits, or carry forwards

- Taxpayers who did not make estimated payments in the prior year

When users log into myPATH, their employer-reported W-2 information will already be uploaded, eliminating the need to manually enter wage and withholding data. Filing can be completed in just a few simple steps,” read the Commonwealth of Pennsylvania’s website. “The Department of Revenue is encouraging taxpayers who have filed previously on a paper return to take advantage of Fast File.

“Using this streamlined online option will save time and help ensure the accuracy of your return.”

Where is my PA state refund?

Pennsylvanians can track the status of their 2025 Pennsylvania state tax refund through the MyPath portal.

When to expect your income tax refund

When you receive your 2025 tax refund depends on when and how you filed tax returns.

In general, you should receive your tax refund about 21 days after your tax returns are accepted and processed.

Financial resource Kiplinger created a breakdown of the IRS tax refund schedule:

Refund Delivery Time Filing and Refund Delivery Methods

- 3 weeks: E-file and direct deposit

- 4 weeks: E-file and check

- 4 to 8 weeks: Mail in return and direct deposit

- 4 to 9 weeks: Mail in return and check

According to the IRS, it could six weeks or longer to receive your tax refund if you submitted paper-based returns by mail.

And it could take longer still for you to receive your refund if there were errors in your return or your return requires further review.

USA TODAY Network via Reuters Connect

Related: Tax season has arrived: Here’s what to know in Pennsylvania

Cod Almighty. Iceland-to-Pgh. connection strong in fish fry season

From parish halls to fire departments, fish at the center of one of the region’s most beloved traditions during Lent is hauled from icy waters...

New ad calls out Bresnahan’s decision to sell Medicaid stocks before gutting the program

US Rep. Rob Bresnahan sold over $150,000 in Medicaid-related stocks before voting to cut the program by $1 trillion. US House Rep. Rob Bresnahan’s...

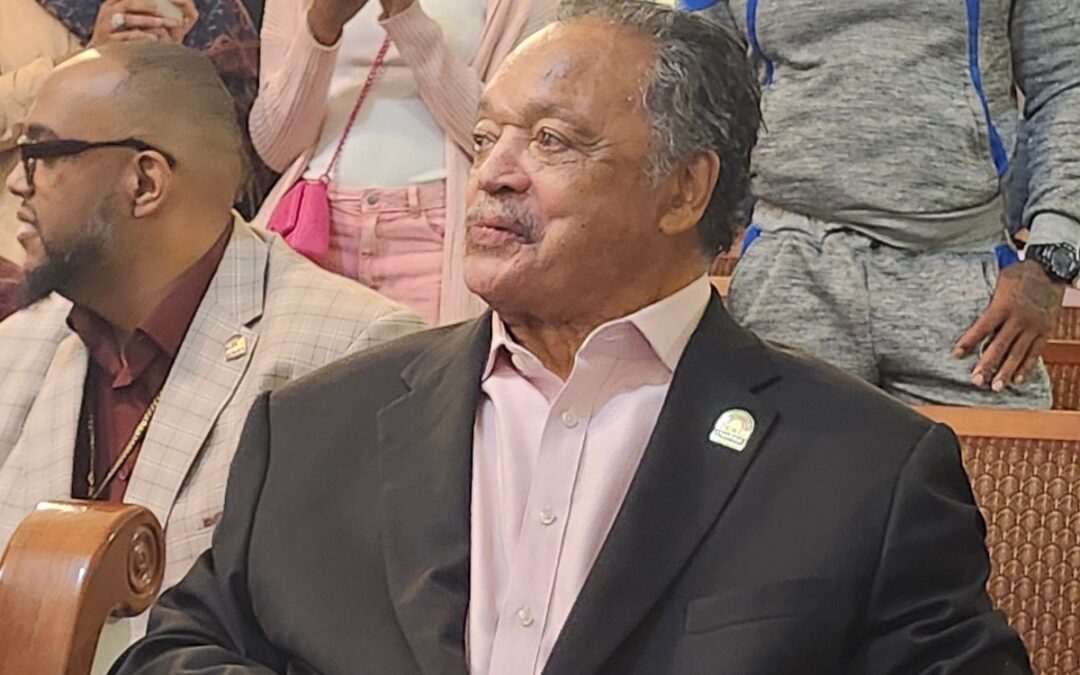

Rev. Jesse Jackson’s inspiring impact remembered by Erie leaders

Erie community members remember Rev. Jesse Jackson’s charisma, activism, and enduring impact on civil rights and community leadership. The Rev....

Anti-ICE town hall draws hundreds in Lancaster County

Residents living in the country’s “refugee capital” push back against Lancaster County’s 287(g) agreements with ICE. Lancaster County may be known...

What to do if you were exposed to measles at the Philadelphia airport

If you traveled through Terminal E at Philadelphia International Airport on Feb. 12, officials are warning of potential measles exposure....