Jim Bognet, Republican Candidate for U.S. Representative for Pennsylvania's 8th District addresses a campaign rally at the Westmoreland Fair Grounds in Greensburg, Pa, Friday, May 6, 2022. (AP Photo/Gene J. Puskar)

Trump-endorsed Republican candidate for US House Jim Bognet has jumped on the GOP bandwagon spreading misinformation about the IRS and the Inflation Reduction Act.

Another Republican has joined the GOP chorus spreading misinformation about the IRS and the Inflation Reduction Act, and this one is seeking to represent NEPA in the US House.

Jim Bognet, who is running against incumbent Democrat US Rep. Matt Cartwright (Lackawanna) to represent Pennsylvania’s 8th Congressional District, took to Twitter earlier this week to add his two cents on the Inflation Reduction Act, which passed the US Senate this week and awaits a House vote.

Like many of his fellow Republicans, the information he spouted about what the bill means for the IRS is incorrect and misleading.

The Inflation Reduction Act would increase the ranks of the IRS, but it would not create a mob of armed auditors looking to harass middle-class taxpayers and small businesses, as Bognet and other Republicans are claiming. While experts say corporate tax increases could indirectly burden people in the middle class, claims that they will face higher taxes are not supported by what is in the legislation.

Bognet’s claim that, with the Inflation Reduction Act, IRS staffing would eclipse the combined workforce of the Pentagon, State Department, FBI, and Border Patrol isn’t true. According to each respective branch, the Pentagon houses approximately 27,000 employees; the State Department employs about 69,000 people; the FBI employs about 35,000 people; and the Border Patrol employs a little over 64,000 men and women.

Last year, before the bill emerged, the US Treasury Department proposed a plan to hire about 87,000 IRS employees over the next decade if funding was available. The IRS will be releasing final numbers for its hiring plans in the coming months, according to a Treasury official. But those employees will not all be hired at the same time, they will not all be auditors, and many will be replacing employees who are expected to quit or retire, experts and officials say. The bill has no mandate to hire 87,000 people.

The IRS currently has about 80,000 employees, including clerical workers, customer service representatives, enforcement officials, and others. The agency said it has lost roughly 50,000 employees over the past five years due to attrition. More than half of IRS employees who work in enforcement are currently eligible for retirement, according to a Treasury Department official.

Budget cuts, mostly demanded by Republicans, have also diminished the ranks of enforcement staff, which fell roughly 30% since 2010 despite the fact that the filing population has increased. The IRS-related money in the Inflation Reduction Act is intended to boost efforts against high-end tax evasion, Sarin said.

The nearly $80 billion for the IRS in the bill will also pay for other improvements, such as revamping the agency’s technology, a move aimed at improving the taxpayer experience with an agency often criticized for its bureaucracy.

Bognet, of Hazleton, was a political appointee for the Trump administration. Trump has endorsed Bognet for Congress, praising him as “pro-wall, pro-life, and pro-gun.”

Information from the Associated Press was used in this story.

Politics

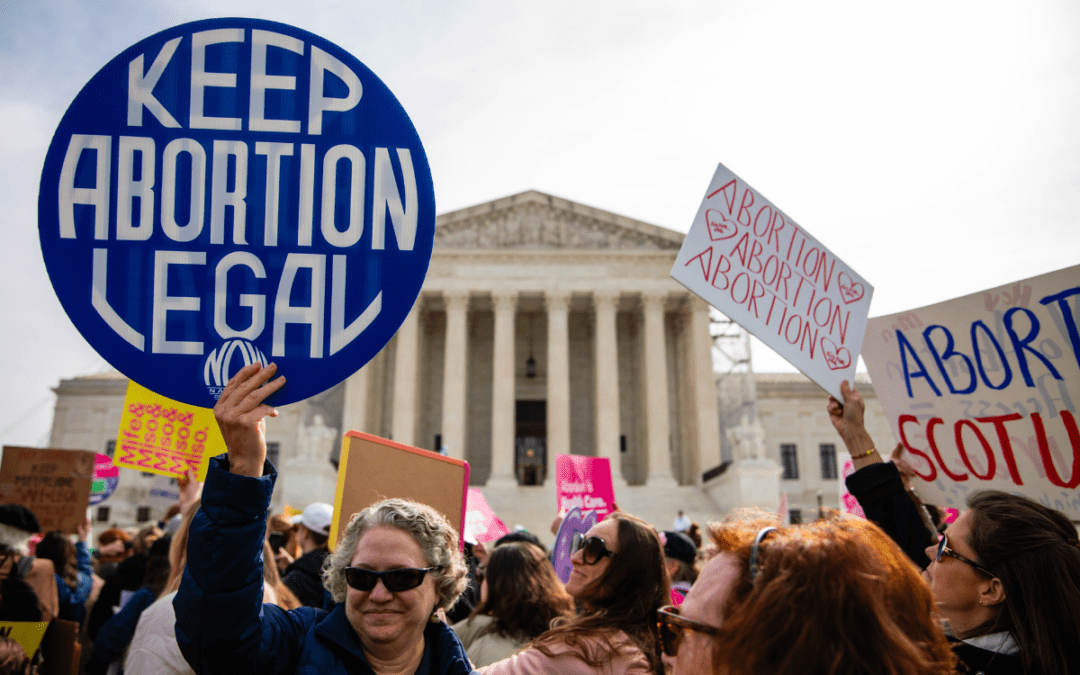

How Project 2025 aims to ban abortion in Pennsylvania

Former president Donald Trump said abortion was a state’s rights issue recently, but conservative organizations, under the banner “Project 2025,”...

736,000 PA households could lose crucial help on their internet bills

Time is running out for the Affordable Connectivity Program, which provides low-cost high speed internet access for over 736,000 Pennsylvania...

What to know about Trump’s legal issues

Over the past year, former president Donald Trump has become the center of not one, not two, not three, but four criminal investigations, at both...

Local News

Conjoined twins from Berks County die at age 62

Conjoined twins Lori and George Schappell, who pursued separate careers, interests and relationships during lives that defied medical expectations,...

Railroad agrees to $600 million settlement for fiery Ohio derailment, residents fear it’s not enough

Norfolk Southern has agreed to pay $600 million in a class-action lawsuit settlement for a fiery train derailment in February 2023 in eastern Ohio,...