A person walks by a restaurant that went out of business in Gramercy as the city continues the re-opening efforts following restrictions imposed to slow the spread of coronavirus on October 21, 2020 in New York City. The pandemic continues to burden restaurants and bars as businesses struggle to thrive with evolving government restrictions and social distancing plans which impact keeping businesses open yet challenge profitability. (Photo by Noam Galai/Getty Images)

And more than 100 loans were given to companies that did not list a business name.

New data released by the Small Business Administration shows a troubling trend within pandemic relief programs: they appear to benefit businesses that can already afford to help themselves.

An analysis by NBC found that wealthy, high profile businesses were more likely to benefit from relief programs like the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan (EIDL), including properties owned by President Donald Trump and his son-in-law Jared Kushner.

Over the spring and summer Congress passed COVID-19 relief aid that was designed to help small businesses weather losses related to the pandemic. The aid came in the form of forgivable loans to be used on allowable expenses like utilities, rent, payroll, and mortgage interest payments.

The Small Business Administration was sued by the Center For Public Integrity and 11 newsrooms to release detailed information about the relief programs. But after months in the courts fighting against releasing this information, the data shows worrisome trends. For example, more than 25 PPP loans worth more than $3 million were given to businesses listed with addresses at Trump and Kushner real estate properties. Of those businesses, 15 reported that they kept only one job, zero jobs, or did not report anything at all.

One loan to Trump and Kushner properties of more than $2 million went to a restaurant at the Trump International Hotel and Tower in New York City. Not only did the company not use the funds to save any jobs, it later closed. Additionally, two tenants at the Trump Tower on 5th Avenue in New York received more than $100,000.

There is also some indication that there was mismanagement within the relief programs. More than 100 loans were given to companies that did not list a business name, entered “no name available,” or showed apparent data entry errors. There were also more than 300 companies that received upwards of $10 million in loans through their subsidiaries.

Government accountability groups were quick to voice their concern over the new data.

“Only now — after its hand has been forced, hundreds of thousands of small businesses have gone under, and millions of taxpayer dollars were wasted — has this administration pulled back the curtains to reveal the malpractice going on behind the scenes,” said Kyle Herrig in a statement. Herrig serves as the president of Accountable.US, a nonpartisan watchdog group. “Americans deserved an open, transparent small business aid program when this pandemic started, and any new small business relief program must take a lesson from the abject failures of this one.”

Accountable.US put together a searchable database, available to the public, in an effort to create more transparency within government relief programs.

News publications and accountability groups alike have worked for months to receive more information about which businesses have received federal loans. This latest release of information came only after the Small Business Administration lost in court.

This is not the Small Business Administration’s first brush with controversy. As loan programs rolled out over the spring and summer, reports showed that large national banks gave loans only to customers they already had relationships with, at least initially. This trend excluded many businesses owned by people of color and people without strong relationships to large banks were stuck with limited access to apply for the loans.

The Small Business Administration also avoided releasing detailed information about who received federal money by claiming it omitted business names for privacy and only listed loan totals in ranges as opposed to specific amounts.

There was also a back-and-forth over what qualified as a “small business” after the hotel and restaurant industry lobbied Congress and increased the maximum number of employees to 500. According to the Small Business and Entrepreneurship Council the vast majority of small businesses in the United state, approximately 98.2%, have fewer than 100 employees.

Herrig called the details of the newest release of data a “shameful dereliction of duty and flagrant mismanagement of a program that millions of workers and small businesses needed to get through this pandemic.”

Politics

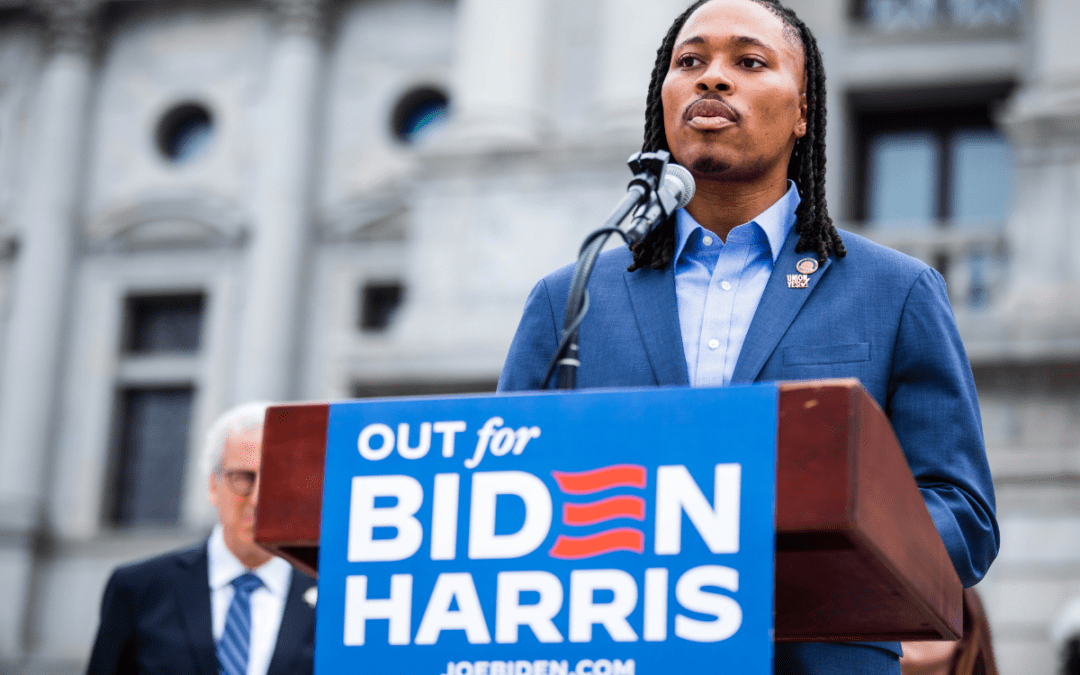

Malcolm Kenyatta makes history after winning primary for Pa. Auditor General

State Rep. Malcolm Kenyatta, who was first elected to the state House in 2018, won the Democratic nomination for Pa. Auditor General and will...

Biden administration bans noncompete clauses for workers

The Federal Trade Commission (FTC) voted on Tuesday to ban noncompete agreements—those pesky clauses that employers often force their workers to...

Philadelphia DA cancels arrest warrant for state Rep. Kevin Boyle on eve of Pa. primary

Philadelphia District Attorney Larry Krasner said a detective had sought the warrant against Boyle, a Democrat whose district includes a section of...

Local News

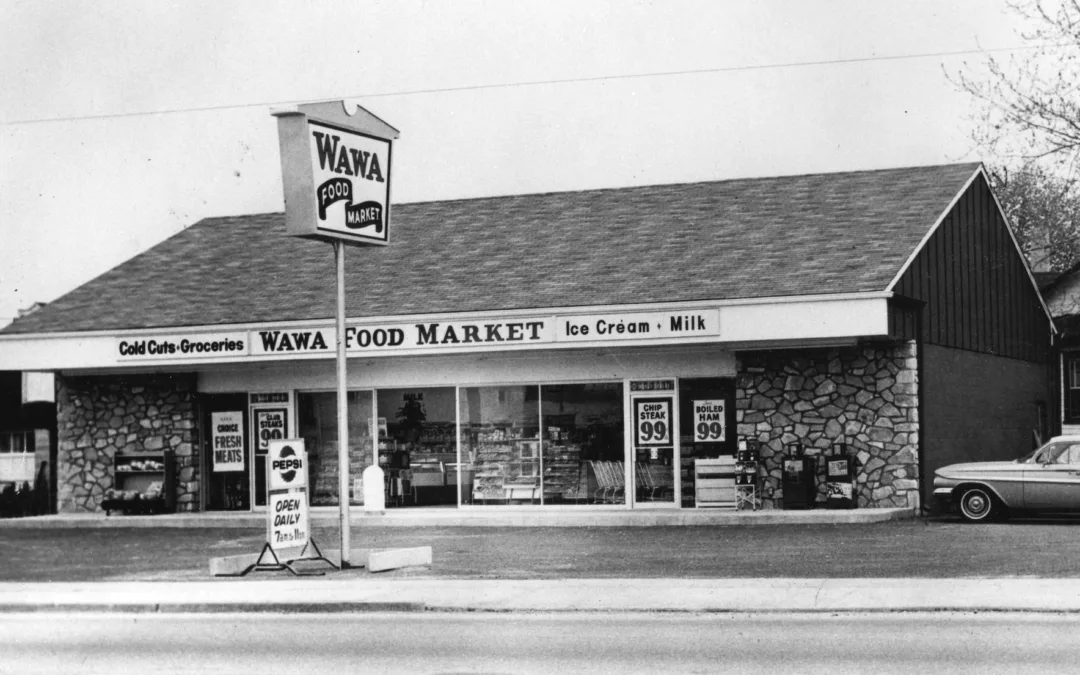

What do you know about Wawa? 7 fun facts about Pennsylvania’s beloved convenience store

Wawa has 60 years of Pennsylvania roots, and today the commonwealth’s largest private company has more than 1,000 locations along the east coast....

Conjoined twins from Berks County die at age 62

Conjoined twins Lori and George Schappell, who pursued separate careers, interests and relationships during lives that defied medical expectations,...