The jump in people worried about medical bankruptcy was largely driven by young people and people of color.

One in two American adults is concerned that a major health event affecting their household could lead to bankruptcy, according to a new poll.

The survey from Gallup and West Health, a nonprofit health group, found that 50% of respondents are “concerned” or “extremely concerned” about a major health event leading to bankruptcy, up from 45% in 2019. The poll was based on interviews conducted with 1,007 adults in July.

This spike was largely driven by young adults and people of color. Fifty-five percent of adults ages 18-29 are worried about bankruptcy due to health events, a 12 point increase from last year. Fifty-five percent of adults ages 30-49 also expressed fears of bankruptcy, compared to only 40% of seniors.

Nearly two-in-three people of color (64%) said they are worried about bankruptcy due to health events, up from 52% in 2019. In comparison, only 43% of white adults share this fear, up only two points from last year. Research has found that some of the same long-standing racial inequities in health status, income, and access to insurance that have made Black and brown communities more vulnerable to COVID-19 make them more likely to accumulate medical debt as well.

“These latest findings illustrate the widespread extent of concern about how catastrophic health events can create financial ruin and the disproportionate impact felt by non-White Americans,” Dan Witters, Gallup senior researcher, said in a statement.

The findings—which come amid a pandemic that has killed nearly 200,000 Americans—underscore the scope of the nation’s health care affordability crisis. The United States spends substantially more on health care than any other wealthy country, without getting any extra benefit.

“Despite significantly higher healthcare spending, America’s health outcomes are not any better than those in other developed countries,” according to a recent analysis from the Peter G. Peterson foundation. “The United States actually performs worse in some common health metrics like life expectancy, infant mortality, and unmanaged diabetes.”

The fear of a medical event leading to bankruptcy is not unfounded. Each year, an estimated 530,000 families are forced to declare bankruptcy due at least in part to medical issues and bills, according to a 2019 study published in the American Journal of Public Health. Nearly 60% of all bankruptcies are caused specifically by medical bills, the report found.

Even those who don’t declare bankruptcy face significant financial consequences from unpaid medical bills, such as difficulty obtaining a mortgage. One in six people in the US have medical debt on their credit report, and collectively owe $81 billion, according to 2016 data in the journal Health Affairs.

Rising health care costs were already a huge problem prior to the coronavirus pandemic. More than 13% of American adults said they had a friend or family member who died over the past five years because they couldn’t pay for medical treatment, according to a 2019 Gallup/West Health survey.

But the problem has spiraled out of control as COVID-19 has devastated the nation’s economy. An estimated 12 million Americans have lost employer-sponsored health insurance coverage during the pandemic, according to research from the Economic Policy Institute. While some of these people may have obtained coverage through Medicaid or the Affordable Care Act marketplace, many others have all but certainly become uninsured altogether.

A recent analysis from the nonpartisan advocacy group FamiliesUSA estimates that more than 30 million Americans are now uninsured amid the coronavirus pandemic.

This widespread lack of insurance coverage could exacerbate the nation’s medical debt crisis, as people are forced to pay for care out-of-pocket or avoid seeking help altogether. An estimated 14% of Americans with likely COVID-19 symptoms said they would avoid care because of cost, according to the Gallup poll. While this might save them money in the immediate term, foregoing care can lead to more severe medical issues and higher costs in the long run.

Democrats in the House have passed bills to lower health care and prescription drug costs, but the Republican-led Senate and White House have refused to engage on the legislation. Instead, the GOP is working to completely upend the nation’s health insurance system.

A coalition of 18 Republican-led states—with the backing of President Donald Trump—are suing to repeal the Affordable Care Act. The case is set to be heard before the U.S. Supreme Court this November. If the ACA is repealed, more than 20 million Americans will lose their health insurance and as many as 133 million people living with pre-existing conditions may once again be denied coverage by insurance companies.

While that lawsuit won’t be heard before Election Day, the healthcare issue looms large over November’s election between Trump and Democratic nominee Joe Biden. Sixty-eight percent of Americans said health care was a “top issue” in determining their vote, making it the second most important issue behind only the economy, according to a recent Pew Research Center survey.

Dan Witters, a senior researcher at Gallup, also expects health care affordability to play a key role for voters.

“As election season intensifies, the lived experiences and priority that Americans place on healthcare cost issues will be very hard for candidates and leaders to ignore,” Witters said.

Politics

It’s official: Your boss has to give you time off to recover from childbirth or get an abortion

Originally published by The 19th In what could be a groundbreaking shift in American workplaces, most employees across the country will now have...

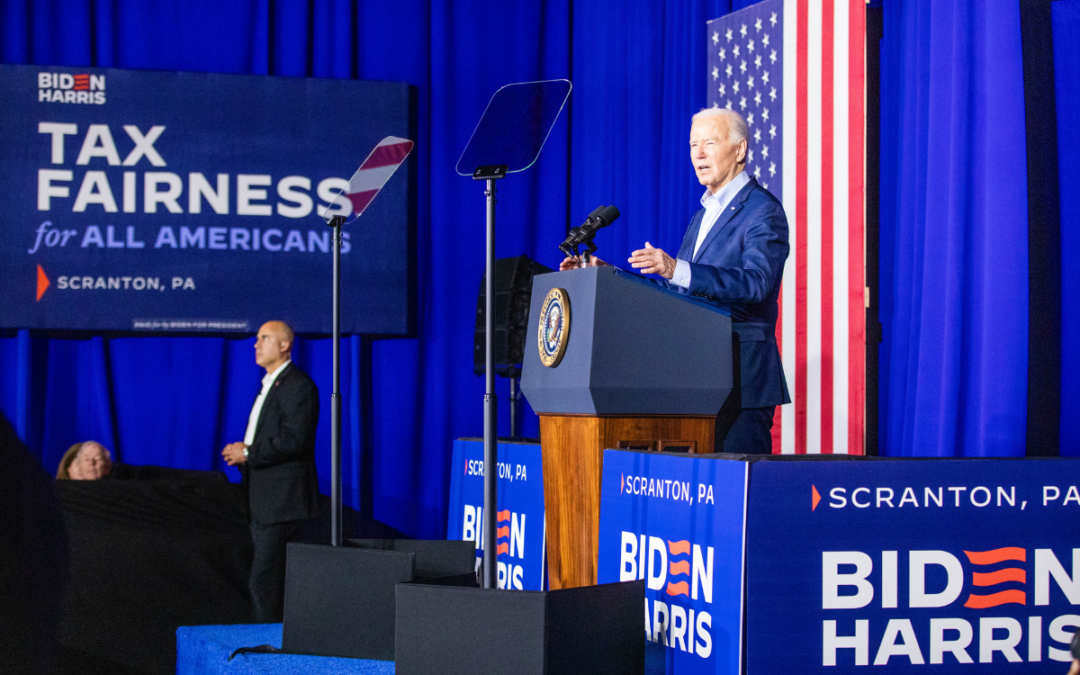

Biden talks economic and tax plans in Scranton

President Joe Biden traveled to Pennsylvania on Tuesday and framed the 2024 election as a choice between Scranton values and Mar-a-Lago values....

Trump says he’s pro-worker. His record says otherwise.

During his time on the campaign trail, Donald Trump has sought to refashion his record and image as being a pro-worker candidate—one that wants to...

Local News

Railroad agrees to $600 million settlement for fiery Ohio derailment, residents fear it’s not enough

Norfolk Southern has agreed to pay $600 million in a class-action lawsuit settlement for a fiery train derailment in February 2023 in eastern Ohio,...

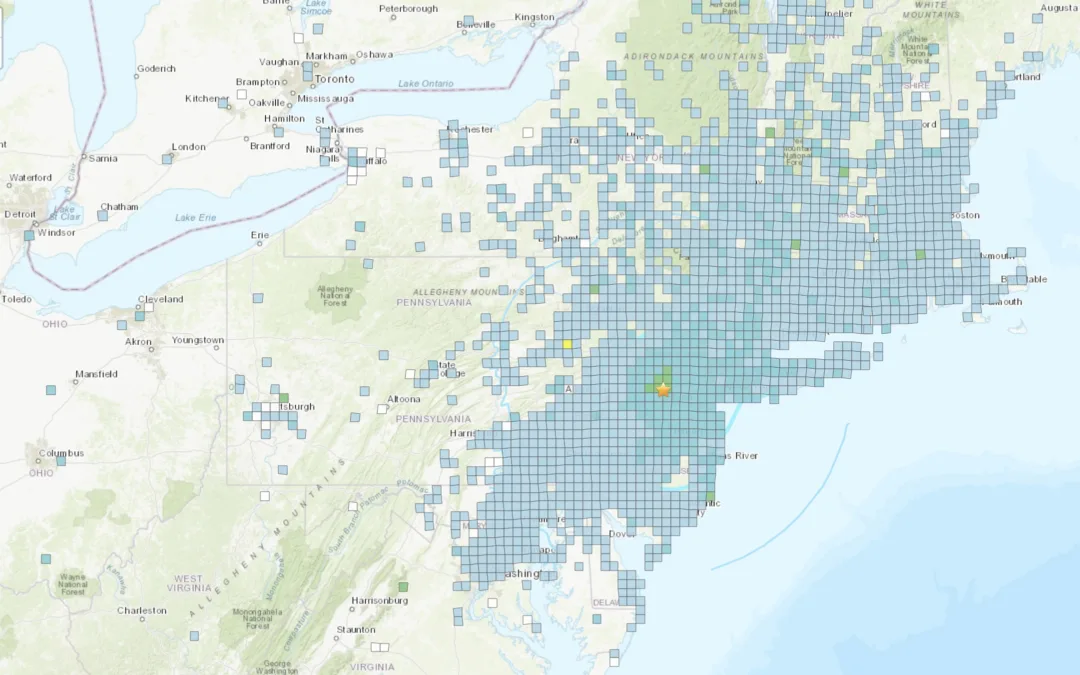

4.8 magnitude earthquake centered in New Jersey felt across Pennsylvania Friday morning

According to the U.S. Geological Survey, the quake’s impact in Pennsylvania was primarily felt in the eastern part of the state, though the...