Graduates line up before the start of commencement. (AP File Photo/Seth Wenig)

Recently announced changes to the Public Service Loan Forgiveness Program will help almost 59,000 public service workers from Pennsylvania on the path to loan forgiveness realize their goal sooner.

New changes to a loan program will put more than 550,000 public service workers closer to being free from student loan debt.

The US Department of Education recently announced an overhaul of the Public Service Loan Forgiveness (PSLF) Program. The changes will be implemented over the next year.

Almost 59,000 public service workers from Pennsylvania are in the program with a total loan debt of $5.4 billion.

“Borrowers who devote a decade of their lives to public services should be able to rely on the promise of Public Service Loan Forgiveness,” US Secretary of Education Miguel Cardona said in a news release. “The system has not delivered on that promise to date, but that is about to change for many who have served their communities and country.”

Federal, state, local, and tribal government and not-for-profit organization employees are eligible for the PSLF Program, which forgives the remaining balance of any direct loans after 120 qualifying payments are made while working full-time in a public service capacity.

“Teachers, nurses, first responders, servicemembers, and so many public service workers have had our back especially amid the challenges of the pandemic,” Cardona said. “Today, the Biden Administration is showing that we have their backs, too.”

The Biden Administration has now approved more than $11.5 billion in loan cancellation for over 580,000 borrowers in this program.

What Changes Will Be Made to the PSLF Program?

A limited PSLF waiver will be available to allow all payments made by borrowers to count toward the program, regardless of loan program or payment plan. A waiver form must be submitted by Oct. 31.

This waiver helps solve the problem for service members who have paused payments while on active duty but were not getting credit toward PSLF.

The US Department of Education will review denied PSLF applications for errors and give borrowers the ability to have their determinations reconsidered. This will help identify and address servicing errors or other issues that have prevented borrowers from getting the PSLF credit they deserve.

The Department of Education is exploring additional steps, such as partnerships with employers, to make the entire process easier.

The new changes will result in 22,000 borrowers who have consolidated loans — including previously ineligible loans — being immediately eligible for $1.74 billion in forgiveness.

Another 27,000 borrowers could potentially qualify for an additional $2.82 billion in forgiveness if they certify additional periods of employment.

The Department of Education estimates that more than 550,000 borrowers who have previously consolidated their loans will see an increase in qualifying payments with the average borrower receiving another two years of progress toward forgiveness. Many more will also see progress as borrowers consolidate into the Direct Loan program and apply for PSLF, and as the Department of Education rolls out other changes in the weeks and months ahead.

Politics

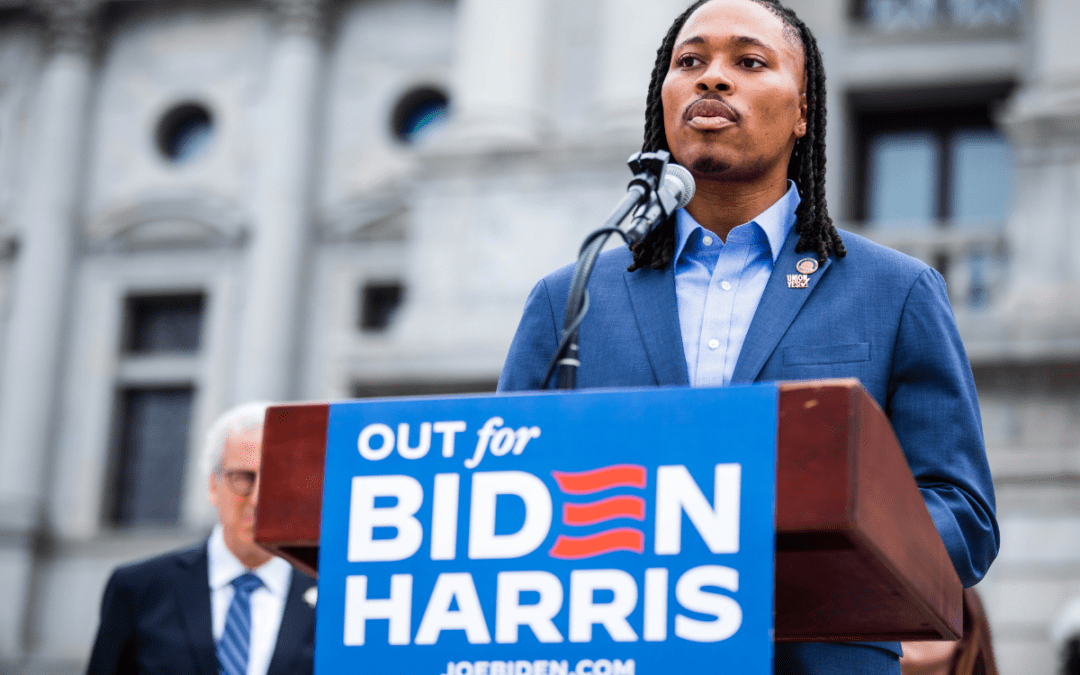

Malcolm Kenyatta makes history after winning primary for Pa. Auditor General

State Rep. Malcolm Kenyatta, who was first elected to the state House in 2018, won the Democratic nomination for Pa. Auditor General and will...

Biden administration bans noncompete clauses for workers

The Federal Trade Commission (FTC) voted on Tuesday to ban noncompete agreements—those pesky clauses that employers often force their workers to...

Philadelphia DA cancels arrest warrant for state Rep. Kevin Boyle on eve of Pa. primary

Philadelphia District Attorney Larry Krasner said a detective had sought the warrant against Boyle, a Democrat whose district includes a section of...

Local News

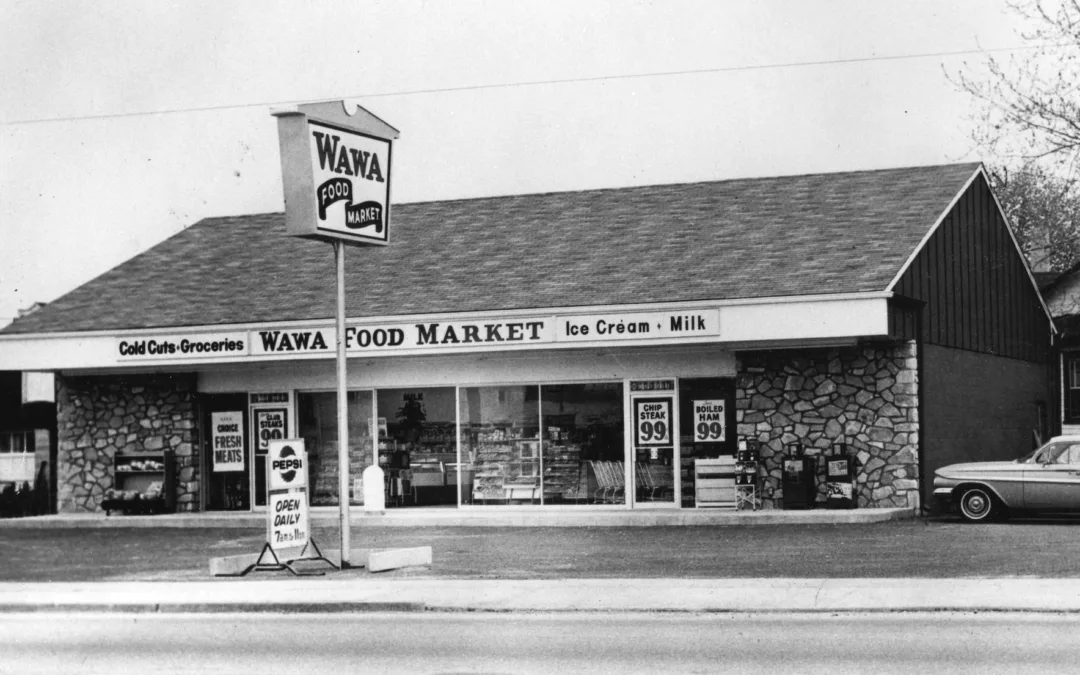

What do you know about Wawa? 7 fun facts about Pennsylvania’s beloved convenience store

Wawa has 60 years of Pennsylvania roots, and today the commonwealth’s largest private company has more than 1,000 locations along the east coast....

Conjoined twins from Berks County die at age 62

Conjoined twins Lori and George Schappell, who pursued separate careers, interests and relationships during lives that defied medical expectations,...