Sara Kennely, cleans one of the dining tables at Max's Allegheny Tavern, Thursday, June 4, 2020. The restaurant taped over the surfaces of some tables to restrict seating to maintain social distancing when patrons are permitted to dine inside when most of southwest Pennsylvania loosens COVID-19 restrictions on Friday. (AP Photo/Keith Srakocic)

A state regulatory commission approved a request from the Wolf administration to raise the base pay of tipped workers, limit tip pooling, and prevent employers from subtracting credit card transaction fees from workers’ tips.

Pennsylvania is updating its Minimum Wage Act.

While the minimum wage isn’t going up, how tipped workers get paid is.

The Independent Regulatory Review Commission unanimously approved a regulation request by the Department of Labor & Industry to raise pay for those who receive a tipped minimum wage.

By taking their request to the commission, the Wolf administration was able to circumvent the legislative process where Republicans have fought raising the minimum wage for years.

“Our embarrassingly low minimum wage has widespread effects that go beyond the unfairly paid workers and their families,” Gov. Tom Wolf said in a prepared statement. “When people earn a decent wage, they can contribute to the economic health of their communities and the commonwealth. When they don’t earn enough to pay for bare necessities, they are forced to rely on public benefits.”

In 2020, 74,400 workers in the commonwealth earned the minimum wage of $7.25 per hour or less (1.3% of all workers).

The commission’s decision updates a rule dating back to 1977 about how employers pay tipped workers. Currently, employers in Pennsylvania must pay at least $2.83 an hour, a level that bumps up to minimum wage if an employee’s tips don’t meet a certain threshold.

The changes will be submitted to the Attorney General’s office for review. Once approved, the updates go into effect in 90 days.

What’s Changing in the Minimum Wage Act?

While the changes are modest, they will give low paid hourly workers a little more income but not impose significant burdens on employers.

The approved changes include the following:

1. Updating the Tip Threshold

The regulation updates the definition of a “tipped employee.” Adjusting for inflation since 1977, it increases the amount in tips an employee must receive monthly from $30 to $135 before an employer can reduce an employee’s hourly pay from $7.25 per hour to as low as $2.83 per hour.

The new threshold will ensure that low-paid workers in industries in which tips are occasional and a small supplement to hourly wages receive a predictable paycheck each period.

2. The 80/20 Rule

Alignment with a recent federal regulation that says workers cannot be paid the tipped minimum wage unless they spend at least 80% of their workday performing tipped work.

3. Limiting Tip Pooling

Tip pooling is the group collection and equal redistribution of tips among workers. This change allows for tip pooling among employees but in most cases excludes managers, supervisors, and other business owners. More tips, as a result, will go to lower-paid employees.

4. Credit Card Fees

This change prohibits employers from deducting credit card processing fees from workers’ credit card tips.

5. Gratuity Clarification

A requirement for employers to inform a patron what part of a bill is a tip/gratuity that goes to the workers and what part of the bill is a service fee that goes to the employer.

6. “Regular Rate” Definition Update

This update clarifies that salaried employees who are entitled to overtime wages should be paid time-and-a-half overtime based on their salary and other compensation divided by 40 hours.

Politics

Bob Casey: Past time to reign in corporations ‘jacking up their prices’

US Sen Bob Casey continued calling out corporate greed and price gouging at a canvass launch in the City of Lancaster on Sunday. Maintaining the...

Susan Wild calls out Republicans for holding up Ukraine aid

‘It’s not only shameful, but embarassing.” That’s what US Rep. Susan Wild (D-Pennsylvania) had to say about the Republican-led US House’s...

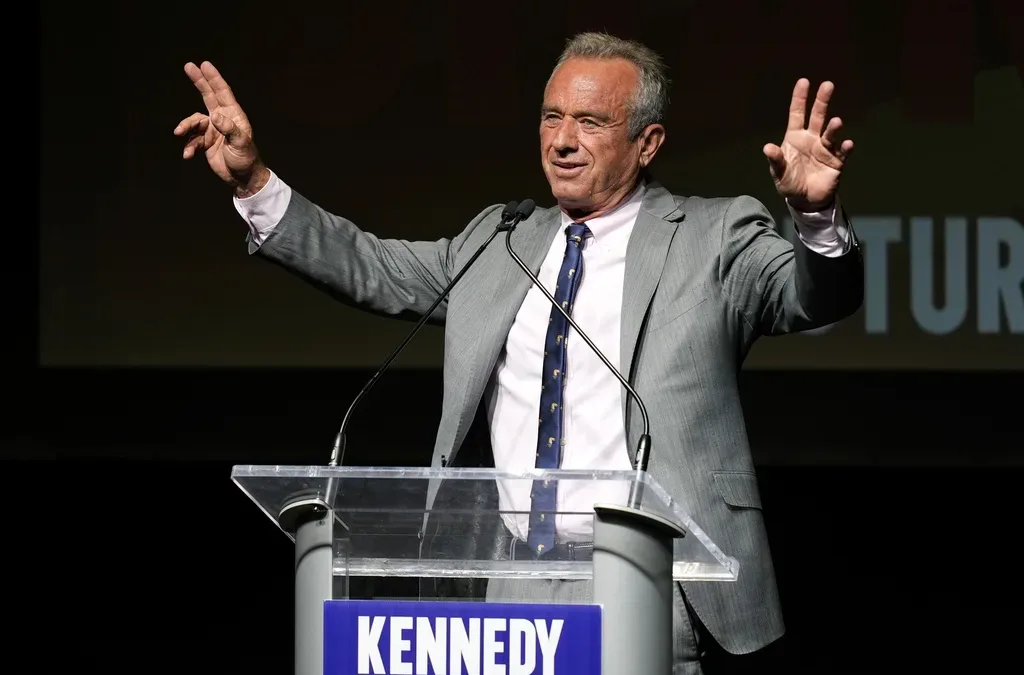

He said what? 10 things to know about RFK Jr.

The Kennedy family has long been considered “Democratic royalty.” But Robert F. Kennedy, Jr.—son of Robert F. Kennedy, who was assassinated while...

Local News

Conjoined twins from Berks County die at age 62

Conjoined twins Lori and George Schappell, who pursued separate careers, interests and relationships during lives that defied medical expectations,...

Railroad agrees to $600 million settlement for fiery Ohio derailment, residents fear it’s not enough

Norfolk Southern has agreed to pay $600 million in a class-action lawsuit settlement for a fiery train derailment in February 2023 in eastern Ohio,...