Alicia Duque, a 35-year-old mother of three and volunteer organizer for the progressive group, Action Together listens to Claudia Glennan at the Edwardsville Pierogi Festival in Edwardsville, Pa., Friday, June 11, 2021. (AP Photo/Matt Rourke)

If the expanded Child Tax Credit was made permanent, Pennsylvania would see a 43% reduction in child poverty every year and more than 2.3 million children would benefit.

Over the past year, Alicia Duque has seen all her household bills — heat, electricity, even the grocery bill — go up.

“The bills have gone up because everyone has been home,” the Pittston mother of three said. “I have three sons. They are always hungry.”

Juggling three kids, two of whom are on the autism spectrum, and working from home has been stressful for Duque and her fiancée, a military veteran. Not only have their household expenses increased, they’ve also incurred additional, unexpected out-of-pocket costs.

Certain therapies her sons need, such as occupational, are often provided by their school. But with the COVID-19 pandemic forcing her school district to go virtual, Duque has had to take the boys elsewhere for services, requiring her to shell out money for insurance copays.

Extra money each month will definitely make a difference for Duque’s family and others who are struggling.

Starting July 15, families will get a little helping hand in the form of monthly checks thanks to the expanded child tax credit included in the American Rescue Plan.

“It can get to be a lot with bills and kids,” Duque said. “For me and my family, the extra money will definitely help this year. ”

What Is the Child Tax Credit?

The expanded credit provides $300 per month per child under age 6 and $250 per month per child ages 6 to 18 to families making less than $150,000 a year. Monthly payments will begin in July and continue through December. Families will then receive another six months worth of payments when they file their tax return next year.

How Would Pennsylvania Benefit if the Credit Became Permanent?

As part of his American Families Plan, President Joe Biden wants to extend the Child Tax Credit expansion through 2025 and make permanent the provision making the full credit available to children whose parents have low or no earnings.

If the expansion is made permanent, more than 2.3 million PA children—89% of all children under the age of 18 in the state—would benefit, according to the Center on Budget and Policy Priorities. Child poverty would be reduced by 43% each year.

About 137,000 children under the age of 18 would be lifted above the poverty line with a permanent expansion.

Black and Latino children in particular were disproportionately left out or left behind with the prior credit. About 320,000 Black and 303,000 Latino children in the commonwealth would benefit from a permanent credit expansion, the Center on Budget and Policy Priorities said.

Pennsylvania families in the poorest income group would receive an average annual benefit of $3,500, according to the Keystone Research Center and PA Budget and Policy Center.

“Just as the expansion of Social Security dramatically reduced poverty among seniors, the expansion of the Child Care Tax Credit puts us on a path to dramatically reducing poverty among children,” Marc Stier, director of the PA Budget and Policy Center, said.

Duque said she knows there are other parents who are struggling, too.

“There are always extra costs with kids you don’t plan for,” she said. “I definitely think it should have been made permanent from the start. Payments spread out throughout the year instead of one big lump sum will help a lot of families with monthly expenses.”

Although the extra assistance will help Duque’s family cover the increase in bills they’ve experienced, they do have other ideas for the added income.

“We had a big wedding planned for ourselves in 2020 but it got canceled,” Duque said. “We are finally having it this August. So that’s been one of our high points to look forward to. And we are looking for a new home.”

Duque said she has been dismayed to hear opposition to the tax credit expansion and making it permanent. Some conservatives have called the child benefit “welfare” and warned that it would bust budgets and weaken incentives to work or marry.

“What’s very frustrating for me is when I hear people who are against this saying that we just need to get back to work,” she said. “We have been working this whole year. I’ve had to become a teacher, a provider, a therapist in addition to my job. Try walking a mile in my shoes before you say anything.”

Politics

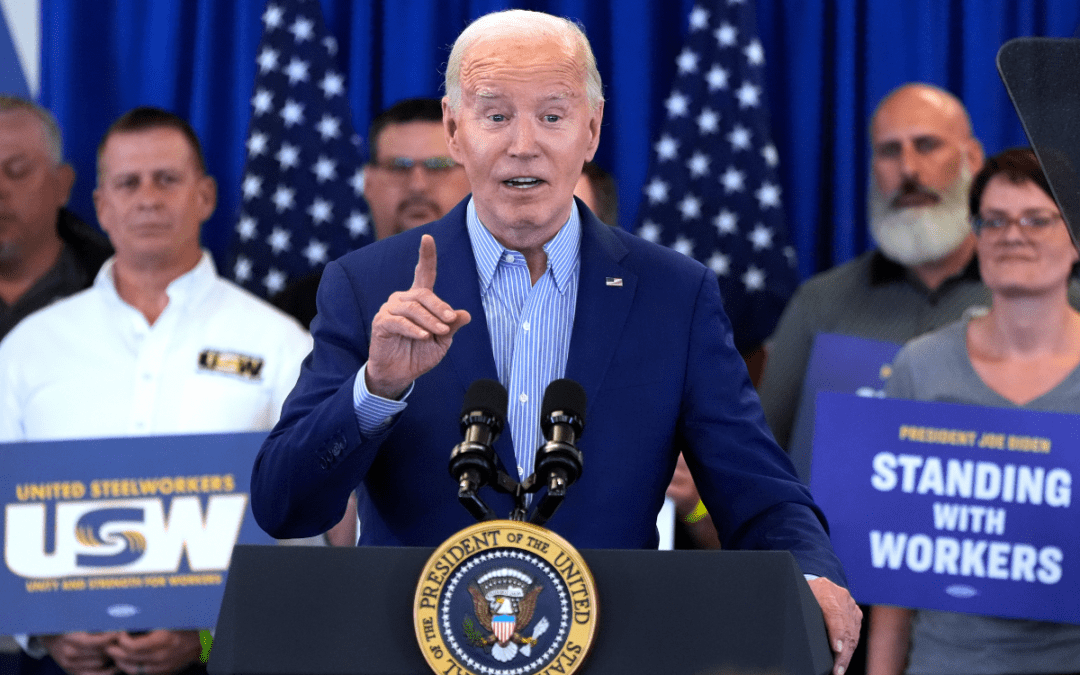

Biden announces tariffs on Chinese Steel while visiting United Steelworkers members

“I'm president because of you guys. I really am and I'm proud. As was mentioned earlier, I'm proud to be the most pro-union president in American...

Opinion: Is Reproductive Healthcare just a women’s issue?

In this op-ed, Pennsylvania resident Lynn Strauss discusses the Republican Party’s conflicting stance on reproductive healthcare policy and the...

2 top US gun parts makers agree to temporarily halt sales in Pennsylvania

Philadelphia filed suit against Polymer80 and JSD Supply last year, accusing the manufacturers of perpetuating gun violence by manufacturing ghost...

Local News

Conjoined twins from Berks County die at age 62

Conjoined twins Lori and George Schappell, who pursued separate careers, interests and relationships during lives that defied medical expectations,...

Railroad agrees to $600 million settlement for fiery Ohio derailment, residents fear it’s not enough

Norfolk Southern has agreed to pay $600 million in a class-action lawsuit settlement for a fiery train derailment in February 2023 in eastern Ohio,...