FILE -Pennsylvania Attorney General Josh Shapiro speaks with members of the media during a news conference, in Philadelphia, Tuesday, March 15, 2022. A massive Republican primary field for governor in Pennsylvania is spurring growing discomfort among party leaders that a widely splintered primary vote could produce a winner who cannot beat Democrat Josh Shapiro in November's general election.(AP Photo/Matt Rourke, File)

Using surplus state cash and federal pandemic aid, Josh Shapiro wants to eliminate state taxes on cell phone bills, give a gas tax refund to car owners, and expand the state’s rent and property tax rebate program.

While Republican candidates for governor talk of a gas tax holiday, the lone Democratic candidate Josh Shapiro has different ideas.

Shapiro unveiled the first tax proposal of his candidacy for governor late last week.

What’s his plan? Eliminate state taxes on cell phone bills, send checks to car-owning households, and expand Pennsylvania’s rent and property tax rebate program.

Shapiro wants to tap into federal pandemic subsidies and multibillion-dollar tax collection surpluses to fund his proposal.

With Republican majorities in the state Legislature, Shapiro might get some pushback if elected governor. The GOP has insisted that federal pandemic aid and state reserves be used conservatively to ward off deficits.

“My plan is fully paid for and would provide real relief for Pennsylvanians today,” Shapiro said at a news conference in Pittsburgh.

Three-Part Plan

1. State Taxes on Cell Phone Bills

Shapiro wants to eliminate state sales and gross receipts taxes on cell phone bills. The 11% tax cut would cost the state $317 million in lost revenue.

Shapiro said his proposed tax cut would offer direct savings to Pennsylvanians who own a cell phone, whereas a gas tax cut necessarily won’t.

“In states that have actually cut the gas tax, what we’ve seen is that the gas and oil executives, they’ve kept 30% of that savings, meaning they don’t pass that savings on to the consumers,” Shapiro said. “So while they’re working to put money in the pockets of oil and gas executives, I’m working to put money in the pockets of Pennsylvanians who right now are dealing with these high costs.”

Shapiro said the loss in revenue would be offset by the surplus in state tax collections.

2. Gas Tax Refund

Termed as a gas tax refund, Shapiro proposes sending households a $250 check for each vehicle they own. With an estimated 8 million passenger vehicles in Pennsylvania, the cost of the refunds would come to about $2 billion.

Shapiro said he would use federal pandemic aid to cover the hefty price tag.

3. Property Tax and Rent Rebate Program

Nearly 500,000 Pennsylvanians benefit from the program annually, according to the state Department of Revenue. The program has delivered more than $7.1 billion to eligible residents since it began in 1971.

The program currently benefits eligible Pennsylvanians who are:

- Age 65 and older

- Widows and widowers age 50 and older

- People with disabilities age 18 and older

Income limits are $35,000 a year for homeowners and $15,000 annually for renters.

Shapiro said he wants to double the income limit for renters to $30,000 a year and increase the limit for property owners from $35,000 to $50,000 a year. The maximum standard rebate would increase from $650 to $1,000.

His proposal would roughly triple the cost, by an estimated $424 million, and potentially increase the number of applicants by 60%. The increase in cost would be covered by surplus state tax collections, he said.

Ashley Adams contributed to this story.

Politics

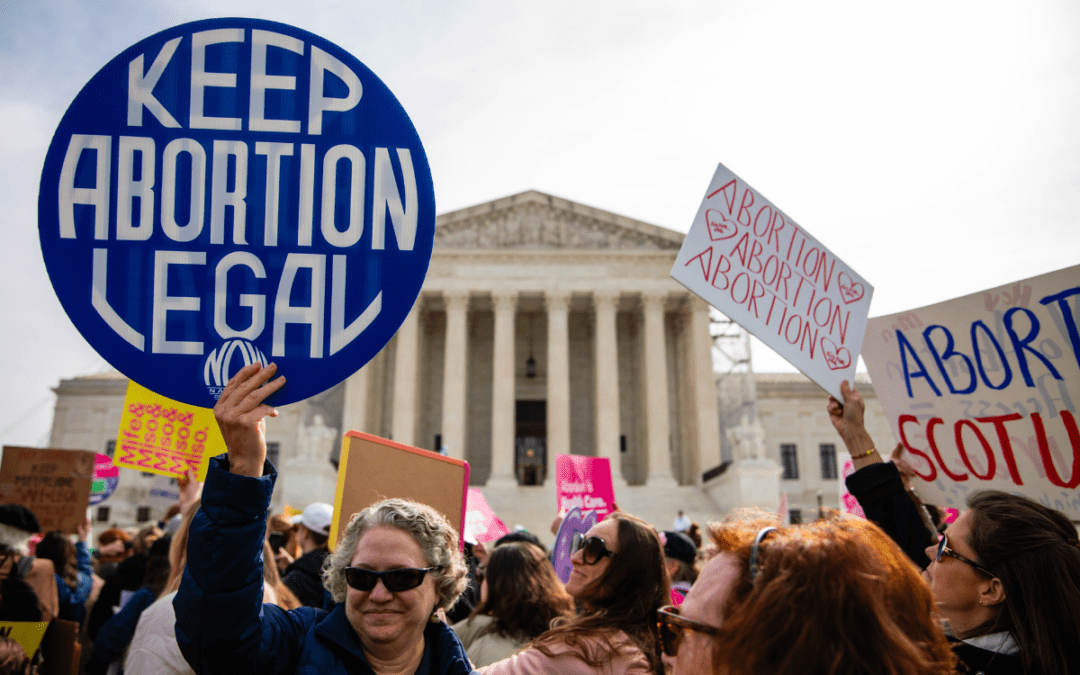

How Project 2025 aims to ban abortion in Pennsylvania

Former president Donald Trump said abortion was a state’s rights issue recently, but conservative organizations, under the banner “Project 2025,”...

736,000 PA households could lose crucial help on their internet bills

Time is running out for the Affordable Connectivity Program, which provides low-cost high speed internet access for over 736,000 Pennsylvania...

What to know about Trump’s legal issues

Over the past year, former president Donald Trump has become the center of not one, not two, not three, but four criminal investigations, at both...

Local News

Conjoined twins from Berks County die at age 62

Conjoined twins Lori and George Schappell, who pursued separate careers, interests and relationships during lives that defied medical expectations,...

Railroad agrees to $600 million settlement for fiery Ohio derailment, residents fear it’s not enough

Norfolk Southern has agreed to pay $600 million in a class-action lawsuit settlement for a fiery train derailment in February 2023 in eastern Ohio,...