Student loan payment moratorium ends on Dec. 31. (Image via Shutterstock)

A recent Pew study found that 58% of borrowers who said their payments had been stopped during the pandemic also noted they would face difficulty if they were required to begin making their payments again.

Borrowers with student loan debt are facing an uncertain future as the Trump administration’s pause on loan repayment is set to expire on Dec. 31—nearly a month before President-elect Joe Biden will take the reins.

Over the weekend, the Department of Education began reminding borrowers via texts and email that their monthly payments will resume on Jan. 1. This summer, President Donald Trump said he planned to extend the payment pause beyond Dec. 31, but it’s unclear whether he plans to keep that promise. So far, the White House has declined to comment on the issue.

Borrowers could have to begin paying their loans again if neither Trump nor Congress decide to avert the coming financial crisis and extend the pause. The moratorium on student loan payments meant that borrowers could temporarily put off their monthly payments without increasing their interest or defaulting on their loans.

Sorting Fact From Fiction: Sign Up For COURIER’s Newsletter

When the new administration steps in on Jan. 20, Biden could implement his own moratorium on student loan payments—or even cancel debt via executive action. But that’s three weeks after payments will have begun being due again.

According to the Student Loan Servicing Alliance, the federal student loan system “is not designed to start and stop at the same time” for its 33 million borrowers. “It would be very chaotic,” executive director Scott Buchanan told Politico.

Borrowers have already experienced some of that chaos. When the Department of Education suspended student loan payments through the CARES Act earlier this year, there were some problems. For instance, the department was sued for continuing to garnish the wages of borrowers who had fallen behind on their payments, even though the practice was put on hold by Congress because of the pandemic. Some loan servicers also incorrectly reported data about the paused payments for about 5 million borrowers, which in turn affected some of their credit scores.

As the economic crisis worsened and unemployment rates skyrocketed, the pause on payments helped borrowers stay out of default and delinquency. It also freed up more money for Americans to buy essential goods like groceries and keep up with their rent.

A recent study conducted by Pew Research Center found that 58% of borrowers whose payments had been stopped during the pandemic said they would face difficulty if they were required to begin making their payments again.

“Student loan debt is holding back a whole generation from buying homes, starting small businesses, and saving for retirement,” Massachusetts Sen. Elizabeth Warren tweeted on Monday. “Executive action to cancel student debt would be a huge economic stimulus during and after this crisis.”

The student debt crisis in the United States is considered an ongoing problem, one that stunts economic growth across the country. Canceling student debt has been linked with better quality of life, including increasing a person’s geographical mobility, their ability to change jobs, and higher income.

According to the Brookings Institute, the amount of student debt in the US now totals about $1.5 trillion.

Advocacy groups and students alike have called on Trump and Department of Education Secretary Betsy DeVos to extend the moratorium on payments until September 2021.

“If the cliff isn’t resolved, borrowers will find it harder than ever to make ends meet as they are thrown back into repayment or forced collections while the economy continues to suffer. Waiting to address the cliff will cause unnecessary stress, confusion, and errors for borrowers, servicers, and collectors alike,” a coalition of nonprofit organizations wrote in a letter to DeVos in October. Among the group of 77 organizations were the American Federation of Teachers, the NAACP, the Center for Responsible Lending, and more.

The coalition urged the Trump administration to make a decision about extending the payment pause by Nov. 15 so that borrowers could plan for the end of the year, but the date came and went without a decision.

“As the pandemic continues to wreak havoc, borrowers need to know they won’t be pushed over this cliff,” the group wrote.

READ MORE: Warren and Schumer: Trump Can (and Should) Cancel Up to $50,000 of Student Debts on His Own

Politics

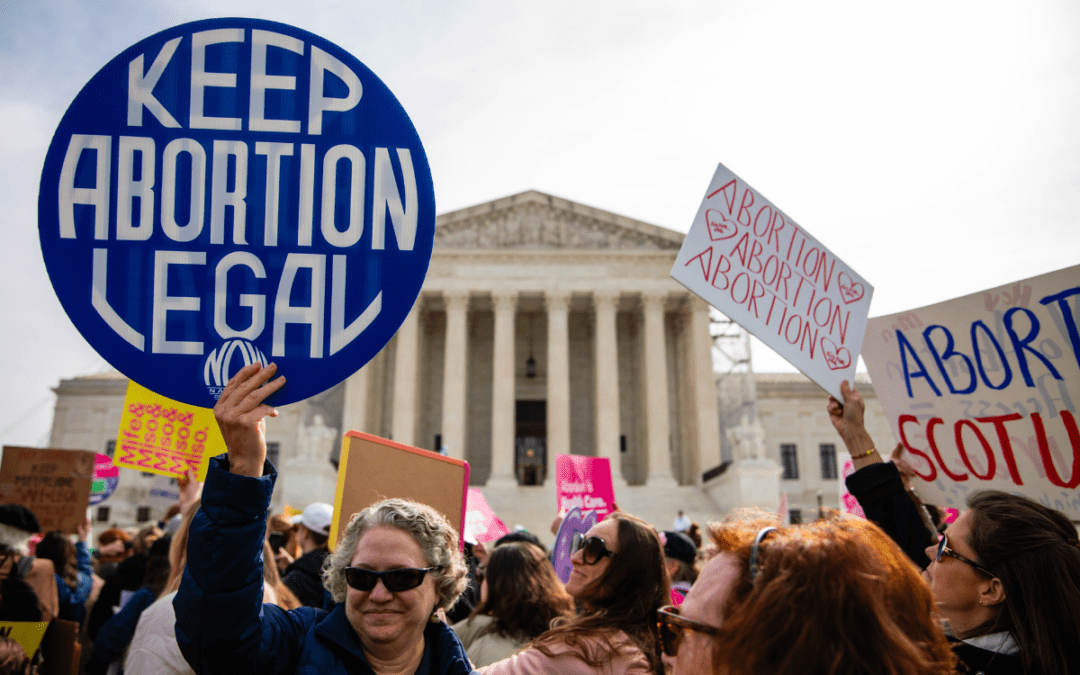

How Project 2025 aims to ban abortion in Pennsylvania

Former president Donald Trump said abortion was a state’s rights issue recently, but conservative organizations, under the banner “Project 2025,”...

736,000 PA households could lose crucial help on their internet bills

Time is running out for the Affordable Connectivity Program, which provides low-cost high speed internet access for over 736,000 Pennsylvania...

What to know about Trump’s legal issues

Over the past year, former president Donald Trump has become the center of not one, not two, not three, but four criminal investigations, at both...

Local News

Conjoined twins from Berks County die at age 62

Conjoined twins Lori and George Schappell, who pursued separate careers, interests and relationships during lives that defied medical expectations,...

Railroad agrees to $600 million settlement for fiery Ohio derailment, residents fear it’s not enough

Norfolk Southern has agreed to pay $600 million in a class-action lawsuit settlement for a fiery train derailment in February 2023 in eastern Ohio,...