Nearly half of all borrowers say they aren't financially prepared to begin repaying their debt. Despite this, interest began accruing again on Sept. 1, and payments will be due again in October. (AP Photo/Jacquelyn Martin, File)

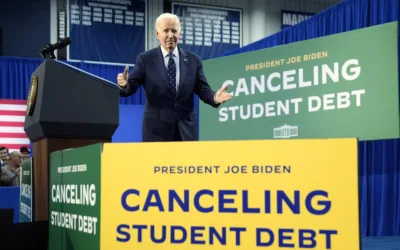

On June 30, the Supreme Court struck down President Biden’s student loan cancellation plan, a major blow to tens of millions of working- and middle-class Americans who stood to benefit from the program.

Under Biden’s plan, an estimated 20 million people were expected to be eligible to have their remaining debt fully canceled, with benefits overwhelmingly flowing to Americans earning under $75,000 per year.

Now, even as nearly half of all borrowers say they aren’t financially prepared to begin repaying their debt, the pandemic-era student loan payment pause is ending. Interest began accruing again on federal student loan debt on Friday, and payments will be due again in October.

The US Department of Education has put together a loan simulator to help borrowers figure out which repayment plan is best for them, based on a range of factors.

Here’s a breakdown of those options as payments restart:

Identify and Contact Your Loan Servicer

First things first, borrowers should take some time to identify, and then contact their individual loan servicers.

During the forbearance period, several federal student loan servicers consolidated with other companies. Therefore, many borrowers’ debts may now be managed by a different servicer than when they last paid.

These borrowers should look through their emails to ensure that they haven’t missed or deleted any notice about changing servicers. To determine who their servicer is now, borrowers should click here, or call the Federal Student Aid Information Center at 1-800-433-3243.

Consider the SAVE Plan

The Biden administration recently launched what it calls “the most affordable repayment plan ever created:” The Saving on a Valuable Education (SAVE) Plan, a new income-driven repayment (IDR) plan.

The SAVE Plan is available to most borrowers and purports to offer the lowest monthly payments of any IDR plan. The plan protects more income from payments and will cut monthly payments to $0 for millions of borrowers making $32,800 or less individually per year. The cutoff will be $67,500 per year for a borrower in a family of four.

Other borrowers will pay no more than 10% of their discretionary income——the difference between their adjusted gross income (AGI) and 225% of the federal poverty line for their family size—on payments. According to the Biden administration, many of these borrowers could save at least $1,000 per year under this plan.

The SAVE Plan will also “stop runaway interest” that “leaves borrowers owing more than their initial loan,” Education Secretary Miguel Cardona said in a statement. For example, under this plan, borrowers with unpaid monthly interest will not be charged as long as they make their monthly payments.

Starting next July, borrowers on the SAVE Plan will also have their payments on undergraduate loans cut from 10% to 5% of discretionary income above 225% of the federal poverty line. Those with undergraduate and graduate loans will pay a weighted average of between 5% and 10% of their income based on the original principal balances of their loans.

For borrowers whose income has significantly increased—or whose family circumstances or household sizes have changed—since the last time they certified their income before the pandemic, it may make more financial sense to stick with their existing repayment plans and delay applying for the SAVE Plan until that decrease goes into effect next summer.

Another SAVE Plan benefit that also goes into effect in July is that borrowers with original principal balances of $12,000 or less will receive forgiveness of any remaining balance after making 10 years of payments.

Click here to learn more about the SAVE Plan.

Explore Other Income-Driven Repayment Plans

Borrowers might also consider pursuing one of several other income-driven repayment plans available.

These plans typically equate to payments of 10% to 20% of a borrower’s discretionary income to make monthly payments more affordable. Like the SAVE Plan, there are also options for $0 monthly payments available for borrowers whose income is low enough.

Borrowers should again keep in mind, however, that lower payments can lengthen the term of a loan, which can in turn increase the interest amount and be more costly to them in the long run. Plus, when the balance on income-driven repayment plans is forgiven after 20 or 25 years, that forgiven amount is considered taxable income.

No action is necessary for those receiving notice of forgiveness, but these borrowers can choose to opt out of the discharge and resume regular payments by contacting their individual loan servicer.

See if You Qualify for Forbearance or Deferment

Borrowers may also consider deferment or forbearance.

In deferment, borrowers do not make regular loan payments. The federal government will pay the interest on subsidized federal student loan payments, but borrowers are still responsible for interest with unsubsidized and PLUS loans. Borrowers can defer their loans for up to three years; they will be required to re-apply every 12 months.

Forbearance suspends, or reduces loan payments temporarily, but interest begins to accrue. Once repayment does eventually occur, the unpaid interest from the forbearance period is added to the loan principal; this is called capitalization.

Borrowers should contact their loan servicers individually to see if they qualify for either of these options.

Remember the ‘On-Ramp’ Period

It’s also worth noting that to help borrowers successfully return to repayment, the Education Department is instituting a 12-month “on-ramp” to repayment, running from Oct. 1, 2023 to Sept. 30, 2024.

Borrowers who miss a payment during this period will not be considered delinquent, reported to credit bureaus, placed in default, or referred to debt collection agencies, according to the White House. While interest will accrue during this period, it will not capitalize at the end of the on-ramp period, meaning the principal amount owed will not increase because of unpaid interest during the nonpayment period.

Borrowers do not have to take any action to qualify for this on-ramp period. The above stipulations will be automatically applied to anyone who misses a payment or is late with payments over these 12 months.

However, borrowers who can make their payments should do so, the White House states. This is because interest will continue to accrue, and therefore balances will continue to grow.

Look for a PSLF-Qualified Job

Many borrowers may be eligible for loan forgiveness through the Public Service Loan Forgiveness (PSLF) program.

As part of PSLF, those who work in a qualifying job for a qualifying government or nonprofit organization for at least a decade are eligible to have their remaining debt forgiven, as long as monthly minimum payments have been made during that time.

Borrowers who are interested in this option might consider looking for full-time work with a company or organization that would qualify them for PSLF. To see if an employer meets the qualifications, click here.

For Rep. Susan Wild, supporting PA families includes reproductive rights and much more

Rep. Susan Wild wants to be very clear with Pennsylvanians: Donald Trump is committed to taking away women’s reproductive freedom, but he is not...

School districts working with anti-LGBTQ groups can cost your kids’ schools millions

Parents across South Central Pennsylvania are worried about the potential financial impacts working with anti-LGBTQ groups may have on their school...

Opinion: Harrisburg Republicans’ Budget Surplus Flip-Flop Reveals True Priorities

Harrisburg Republicans have spent years honing a simple political strategy that could be described as oppose, pander, and negotiate in bad faith....

Central PA school board director cancels himself over gay guest speaker fallout

The Cumberland Valley School Board director resigned in protest on Monday after the board voted to reinstate Maulik Pancholy. The board originally...

New book details how Dave McCormick profited from 2008 financial crisis

Dave McCormick forged a relationship with Ray Dalio, the founder of Bridgewater Associates, in early 2008 and was rewarded with a job at Bridgewater...