FILE - In this May 5, 2018, file photo, graduates at the University of Toledo commencement ceremony in Toledo, Ohio. (AP Photo/Carlos Osorio, File)

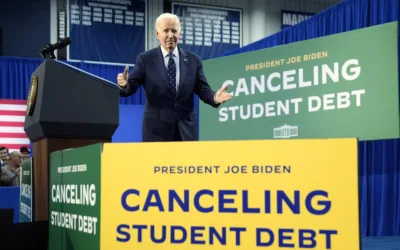

The Biden administration on Wednesday announced that it approved the cancellation of nearly $5 billion in additional federal student loan debt for more than 80,000 borrowers, providing relief to many middle- and working-class borrowers.

Borrowers who qualify for student debt relief through Wednesday’s announcement from the US Department of Education fall into two categories: they either participated in the Public Service Loan Forgiveness (PSLF) plan, or they made at least 20 years of qualifying payments in an income-driven repayment (IDR) plan.

Many of these borrowers were informed last month that their outstanding federal student loan debt would be canceled, and they’ll be able to see their new balances in the coming weeks.

“From Day One of my Administration, I vowed to improve the student loan system so that a higher education provides Americans with opportunity and prosperity – not unmanageable burdens of student loan debt,” President Biden said in a statement Wednesday. “I won’t back down from using every tool at our disposal to get student loan borrowers the relief they need to reach their dreams.”

Those on an IDR plan have been making payments, but never got the relief they were promised, according to the White House. The Department of Education said in July that qualifying monthly payments that “should have moved borrowers closer to forgiveness were not accounted for,” effectively forcing these borrowers to make extra payments under their IDR plans.

Those getting relief under the Public Service Loan Forgiveness program include individuals who have been working in a government or nonprofit position, such as a teacher, firefighter, or police officer, for more than 10 years.

“The latest discharges are a result of this administration’s relentless efforts to fix our country’s broken student loan system and get hard-earned debt relief into the hands of eligible borrowers,” Education Secretary Miguel Cardona said on a call with reporters.

Wednesday’s announcement is just the latest round of student debt cancellation enacted by the Biden administration, which has approved $132 billion in relief for more than 3.6 million people.

This includes nearly $42 billion in debt relief for roughly 855,000 borrowers nationwide who are eligible for forgiveness through IDR plans and $51 billion in relief for 715,000 public servants through various forgiveness programs. More than 500,000 borrowers with permanent or total disabilities have also received debt relief. Finally, 1.3 million borrowers who were misled or defrauded by institutions such as the for-profit University of Phoenix, saw their institutions suddenly close, or who are covered by related court settlements have received relief.

Since Oct. 2021, 33,120 Pennsylvanians have had $2.3 billion in student debt discharged via PSLF.

Additionally, nearly 34,000 Pennsylvanians have been identified for debt relief due to changes to the IDR plans, as of mid-Nov. 2023.

To date, the Biden administration has granted more student debt relief than any other administration, but the president’s wide-ranging student loan cancellation plan was struck down by the US Supreme Court in June.

The administration has responded to that ruling by beginning a process to provide more narrow relief to borrowers whose current balances are higher than the figure they originally owed or who were eligible for relief under specific programs but didn’t apply, for example. The White House is also looking to help borrowers who are experiencing significant “financial hardship,” and those who went through programs that didn’t “give financial value,” though there’s no word yet on the specifics.

“We are continuing to pursue an alternative path to deliver student debt relief to as many borrowers as possible as quickly as possible,” Biden said in a statement Wednesday.

Options for Repayment

Student loan repayments resumed on Oct. 1, after a three-year, pandemic-induced pause.

To help borrowers successfully return to repayment, the Education Department has instituted a 12-month “on-ramp” to repayment, running from Oct. 1, 2023 to Sept. 30, 2024. Borrowers who miss a payment during this period will not be considered delinquent, reported to credit bureaus, placed in default, or referred to debt collection agencies, according to the White House.

The Biden administration also recently launched what it calls “the most affordable repayment plan ever created:” The Saving on a Valuable Education (SAVE) Plan, a new income-driven repayment (IDR) plan.

The SAVE Plan is available to most borrowers and purports to offer the lowest monthly payments of any IDR plan. The plan protects more income from payments and will cut monthly payments to $0 for millions of borrowers making $32,800 or less individually per year. The cutoff will be $67,500 per year for a borrower in a family of four. According to the Dept. of Education, nearly 5.5 million borrowers have enrolled in the plan so far.

Other borrowers will pay no more than 10% of their discretionary income—the difference between their adjusted gross income (AGI) and 225% of the federal poverty line for their family size—on payments. According to the Biden administration, many of these borrowers could save at least $1,000 per year under this plan.

If you’re a borrower still making your student loan payments, you can learn more about your options here.

For Rep. Susan Wild, supporting PA families includes reproductive rights and much more

Rep. Susan Wild wants to be very clear with Pennsylvanians: Donald Trump is committed to taking away women’s reproductive freedom, but he is not...

School districts working with anti-LGBTQ groups can cost your kids’ schools millions

Parents across South Central Pennsylvania are worried about the potential financial impacts working with anti-LGBTQ groups may have on their school...

Opinion: Harrisburg Republicans’ Budget Surplus Flip-Flop Reveals True Priorities

Harrisburg Republicans have spent years honing a simple political strategy that could be described as oppose, pander, and negotiate in bad faith....

Central PA school board director cancels himself over gay guest speaker fallout

The Cumberland Valley School Board director resigned in protest on Monday after the board voted to reinstate Maulik Pancholy. The board originally...

New book details how Dave McCormick profited from 2008 financial crisis

Dave McCormick forged a relationship with Ray Dalio, the founder of Bridgewater Associates, in early 2008 and was rewarded with a job at Bridgewater...