People participate in a "March on Billionaires" event on July 17, 2020 in New York City. The march, which included a diverse group of activists, politicians and citizens, called on New York Governor Andrew Cuomo to pass a tax on billionaires and to fund workers excluded from unemployment and federal aid programs. Joining the marchers were dozens of taxis whose drivers have been especially impacted by the drop ridership due to Covid-19. According to data from the Organization for Economic Cooperation and Development, income inequality in the United States is the highest of all G7 nations. (Photo by Spencer Platt/Getty Images)

A tax loophole allowed the richest Americans to shield their investments and sit on $8.5 trillion in untaxed profits in 2022, according to a report released last week by American for Tax Fairness.

The report, which was based on an analysis of Federal Reserve data, found that although these Americans—who are each worth more than $100 million—made up just .05% of all American households in 2022, they held one-sixth of the “unrealized capital gains” in the United States that year.

While most American families must work and earn paychecks to support themselves, these unrealized gains function as the primary source of income for many ultra-wealthy families, according to the report.

Current law states that growth in the value of assets–such as stocks, bonds, and real estate and business investments–isn’t taxable until they are “realized,” or sold. Therefore, centimillionaires and billionaires are able to live off these “unrealized” gains by taking out low-interest loans against their wealth. Ultimately, these fortunes turn into inheritances, and that money never gets taxed—unless Congress closes that loophole.

Democratic lawmakers have sought to remedy the problem, introducing a “Billionaires Income Tax” in both the House, and the Senate. The tax would apply to those unrealized capital gains, and according to data, could generate an estimated $500 billion in new revenue in the United States over the next 10 years.

President Joe Biden also supports fixing the loophole in order to tax unrealized gains, but these efforts have received zero support from Republicans.

During Biden’s 2023 State of the Union speech, he called out billionaires who pay lower taxes than the middle class.

“Let’s finish the job. Reward work, not just wealth. Pass my proposal for a billionaire minimum tax,” he said. “Because no billionaire should pay a lower tax rate than a school teacher or a firefighter.”

Without congressional action, it’s predicted that the wealth of the ultra-rich will continue to grow. Since the Federal Reserve began collecting data on American household income and wealth 35 years ago, households worth more than $100 million have nearly tripled their share of the country’s unrealized gains, according to the report.

This disparity in how the ultra-wealthy are taxed only serves to deepen racial divides in the country, as well, the report says. Of that $8.5 trillion in 2022, almost 90% of it was held by white households.

Pa. congressman calls on colleagues to reject deal to end shutdown without health care plan

Premiums are expected to nearly double or even triple in some cases for almost 500,000 Pennsylvanians if tax credits expire. Late Sunday night,...

Shutdown-ending vote reveals rift among Democrats

Some Democrats are left wondering why eight of their own caved on Sunday to end the government shutdown following major election victories. ...

Pa. Democrats gain ground in Trump counties following election

Democrats scored wins in parts of Pennsylvania that supported President Donald Trump during the 2024 election. In statewide and county and municipal...

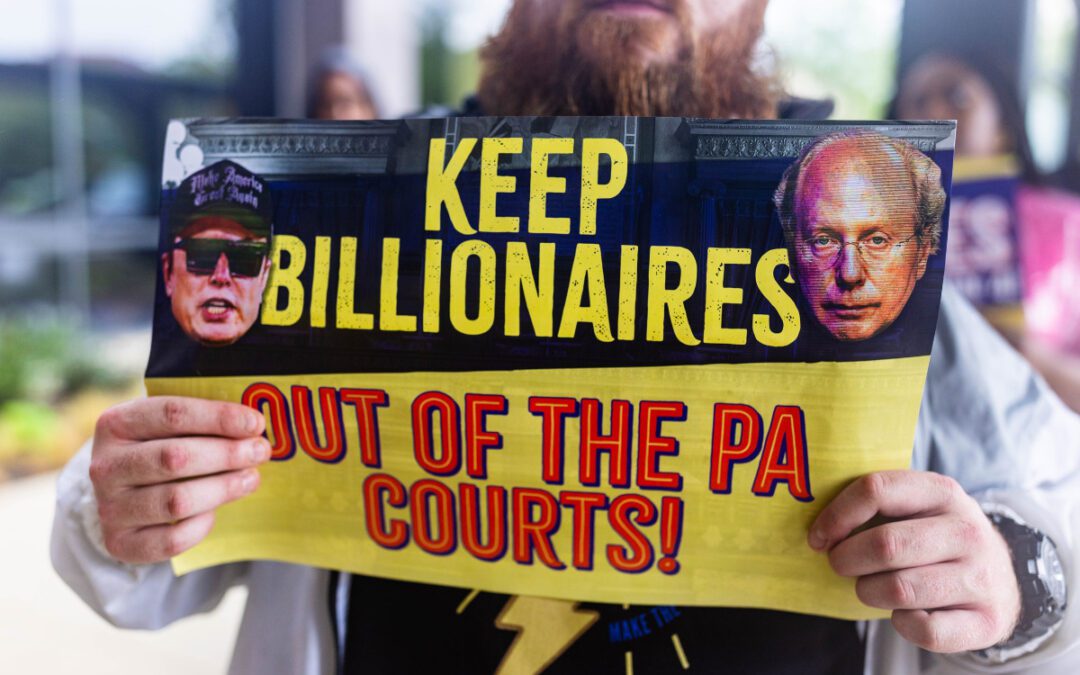

Billionaire Jeffrey Yass named as donor to Trump’s $250 million White House ballroom

This is the latest in a long history between Jeffrey Yass and President Donald Trump. Jeffrey Yass, Pennsylvania’s richest billionaire and GOP...

George Santos came to the Poconos after Trump commuted his prison sentence

After being released from prison on Oct. 17, Republican former congressman George Santos didn’t waste any time enjoying his freedom. And where did...