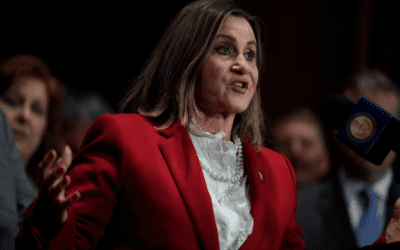

Gov. Josh Shapiro talking to Pennsylvania State Troopers during the Commonwealth Job Fair at the PA Farm Show Complex in Harrisburg, PA on May 14, 2024. (Photo: Sean Kitchen)

Pennsylvania seniors and disabled residents will have until Dec. 31 to apply for their property tax and rent rebate from the Department of Revenue.

Gov. Josh Shapiro announced on Thursday that his administration is extending the deadline from June 30 to Dec. 31, 2024 for the Property Tax and Rent Rebate program.

Pennsylvania seniors and disabled residents are encouraged to go to the Pennsylvania Department of Revenue’s website, mypath.pa.gov, to apply for their rebates.

Shapiro expanded the rebate program for the first time since 2006 with bipartisan support. The expansion increased rebates for eligible residents from $650 to $1,000 and increased the income limits for homeowners and renters to $45,000.

“So far this year, our agency has already received approximately 445,000 rebate applications,” Secretary of Revenue Pat Brown said in a statement.

“That’s roughly 100,000 more applications than we had received at this time last year — and the applicant pool thus far includes nearly 80,000 first-time filers who will be benefiting from the rebate program for the very first time.”

Lawmakers also included a cost of living adjustment in the program’s expansion, which will help keep eligible residents in the program after their pension or social security income are adjusted for changes in inflation. Previously, seniors or disabled residents would get pushed into a different income bracket or lose their eligibility altogether.

Those eligible for the rebate program include seniors over the age of 65, widows or widowers over the age of 50 and disabled residents over the age of 18.

Homeowners and renters who are eligible for the program can receive the following rebates based on their income:

- Residents making $0 to $8,000 are eligible for a rebate up to $1,000

- Residents making $8,001 to $15,000 are eligible for a rebate up to $770

- Residents making $15,001 to $18,000 are eligible for a rebate up to $460

- Residents making $18,001 to $45,000 are eligible for a rebate up to $380

“The Property Tax/Rent Rebate program has long been a lifeline for our seniors and people with disabilities, especially those on a fixed income,” Shapiro said in a statement. “This is what it looks like when we work together, put partisanship aside, and get stuff done for Pennsylvania.”

Support Our Cause

Thank you for taking the time to read our work. Before you go, we hope you'll consider supporting our values-driven journalism, which has always strived to make clear what's really at stake for Pennsylvanians and our future.

Since day one, our goal here at The Keystone has always been to empower people across the commonwealth with fact-based news and information. We believe that when people are armed with knowledge about what's happening in their local, state, and federal governments—including who is working on their behalf and who is actively trying to block efforts aimed at improving the daily lives of Pennsylvania families—they will be inspired to become civically engaged.

Record number of PA seniors are applying for Shapiro’s property and rent tax credits program

Over 445,000 Pennsylvania seniors have signed up for their property tax and rent rebates so far this year. That’s 100,000 more applications thanks...

Opinion: Families of disabled anxious as budget discussions begin

As Pennsylvania budget discussion begins, families of individuals with Intellectual Disabilities/Autism (ID/A) and Direct Support Professionals...

Under expanded PA program, many seniors can save on property tax or rent. Here’s how.

The June 30th deadline for Pennsylvania seniors and disabled residents to apply for a rebate from the Property Tax and Rent Rebate Program is...

Opinion: Harrisburg Republicans’ Budget Surplus Flip-Flop Reveals True Priorities

Harrisburg Republicans have spent years honing a simple political strategy that could be described as oppose, pander, and negotiate in bad faith....

Democrats advance election bill in Pennsylvania long sought by counties to process ballots faster

HARRISBURG, Pa. (AP) — Pennsylvania's House of Representatives on Wednesday approved a bill long sought by counties seeking help to manage huge...