With limited coverage for adult dental care and lofty out-of-pocket costs, some patients are turning to dental credit cards—but experts say these cards are “predatory.” (Photo via Getty Images)

With limited coverage for adult dental care and lofty out-of-pocket costs, some patients are turning to dental credit cards—but experts say these cards are “predatory.”

When it comes to visiting the dentist, which is more frightening: the dental procedures themselves or the lofty bills that sometimes accompany those treatments? For many Americans—particularly those who are uninsured—making a trip to the dentist is an expensive affair, especially when visits include more than a simple cleaning.

Those extra dollar signs might have you wondering whether a specialized dental credit card could help ease the financial burden. For many patients, though—particularly those with poor credit or low incomes—these cards pose a significant risk of increasing overall medical debt.

Prohibitive dental costs push patients toward risky payment methods

According to the American Dental Association (ADA), about 23% of Americans don’t have dental insurance. And even among those who do have insurance, costs can be a challenge—while you might be entitled to a fully covered cleaning twice per year, dental insurance rarely covers the entire cost of additional treatments like root canals, fillings, crowns, dental implants, or dentures.

Per Investopedia, the average national out-of-pocket cost for dental work begins at $98 for a simple cleaning and extends up to $2,000 for a dental implant. Non-insured dental patients can expect to be charged an average of $1,416 for a crown and $1,109 for a root canal.

What’s more, a 2022 report from the ADA illustrated that price is prohibitive for many would-be dental patients, with 12.7% of Americans forgoing necessary dental services that year due to cost. This is more than double the percentage of Americans who avoided necessary non-dental medical care due to cost—just 5.1%.

With these mounting costs, it’s easy to see why a dentist-specific credit card might be tempting.

Dental credit cards are fundamentally identical to typical credit cards, except for the fact that they can only be used to cover dental expenses. But like a typical credit card, specialized dental cards can be a slippery slope for those who can’t make complete payments within the provided time periods, ultimately leading to further debt and even more financial stress.

CareCredit is among the most notable medical credit card companies, offering dental cards with “promotional periods” that sometimes set customers up for failure. Depending on which card you choose, CareCredit touts a six to 24-month promotional period during which your balance will accrue 0% interest—but this doesn’t mean your interest disappears if you can’t pay off the entire balance during those six to 24 months.

Instead, cardholders with any remaining balance after the promotional period must pay the deferred interest on their original balance, plus interest accrued after that period ends.

‘Predatory’ medical credit cards run high risk of adding to personal debt

Some experts say that medical and dental credit card companies’ practices are more than just risky: they’re downright predatory.

“Deferred interest credit cards are a profit-making scheme that needlessly leave patients and families in an endless cycle of debt,” said Mona Shah, Senior Director of Policy and Strategy at Community Catalyst, a health advocacy organization. “These unfair, deceptive, and abusive practices are especially harmful to patients who are already struggling to pay their bills.”

The numbers back up these claims of predatory behavior. In fact, a report from the Consumer Financial Protection Bureau (CFPB) regarding medical credit cards was enough to push the Biden administration to publicly caution Americans about the risks of these cards last year.

The CFPB said that from 2018 to 2020, Americans paid $1 billion in deferred interest on cards like those issued through CareCredit. The impact of deferred credit on medical or dental credit cards is enough to inflate patients’ overall medical bill costs by 25%, the agency calculated—especially because post-promo interest rates sometimes climb as high as 27%.

And, the CFPB reported, low-income patients and those with low credit scores are particularly at risk of falling prey to the deceptive promises of medical or dental credit cards. Their study concluded that while 10% of borrowers with excellent credit were unable to complete payments before the end of the deferred interest period, this number jumped to around 25% for borrowers with low credit scores.

Groups like Community Catalyst argue that these cards should be banned entirely.

“We urge the CFPB to prohibit medical and dental providers from promoting and offering deferred interest credit cards to their patients,” wrote Shah in a letter to the CFPB last year. “Deferred-interest credit cards particularly harm low-income patients and those who experience unexpected financial setbacks that prevent them from paying off the balance before the end of the promotional period.”

Polling from Community Catalyst showed that 61% of voters would support a policy proposal to ban medical and dental credit cards.

Medicaid offers help to low-income dental patients, but gaps remain

So, what’s the solution if you’re in urgent need of dental care but can’t afford your bill at the time of service?

If you’re simply looking to buy a short few weeks of time until you can afford to pay off your dental work in full, a specialized dental credit card from CareCredit or another company might be worth considering. But if there’s any doubt whatsoever about your ability to pay within the promotional window, you’re likely better off pursuing alternative funding options to avoid accumulating debt.

Before signing up with a dental credit card company, patients are encouraged to speak with their dentist about potential payment plans or assistance options for those without insurance. Other patients prefer to seek care at a local dental school, where discounts are available.

Medicaid provides another source of support for families in need of comprehensive and affordable dental care, though it’s not without its gaps. All states are required to provide dental insurance for children covered under Medicaid or the Children’s Health Insurance Program (CHIP), but dental benefits for adults are decided on a state-by-state basis.

As of 2022, only 25 states and Washington, DC offered “extensive” Medicaid dental coverage for adults beyond emergency care. Fourteen states offered “limited” benefits beyond emergencies, while eight states offered only emergency dental care and three states offered no dental coverage at all for Medicaid-covered adults.

Oral health disparities are especially notable among marginalized populations. A report from KFF said that “people of color are more likely to experience oral health problems and are less likely to receive dental care compared with white individuals. People living in rural areas also experience worse oral health outcomes and have more difficulty accessing care than those living in urban areas.”

Analysis from KFF points to expanded Medicaid coverage and reinforcement of a robust dental workforce as goals for addressing these oral health disparities—and, in turn, likely reducing the number of Americans forced to pursue financially risky methods like specialized dental credit cards as a means of obtaining necessary oral health treatments.

Mom’s ‘miracle’ baby defies odds after rare pregnancy rupture

Ericka Michel was standing on a stepstool in her Corry living room, spreading joint compound on drywall, when a small gush of fluid flowed between...

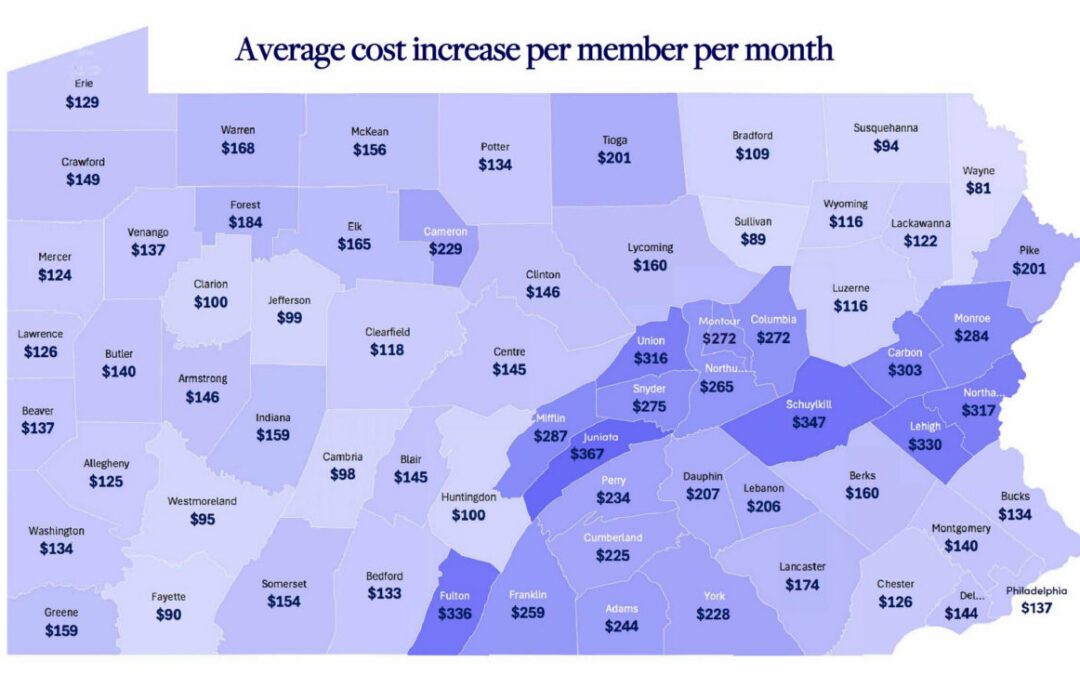

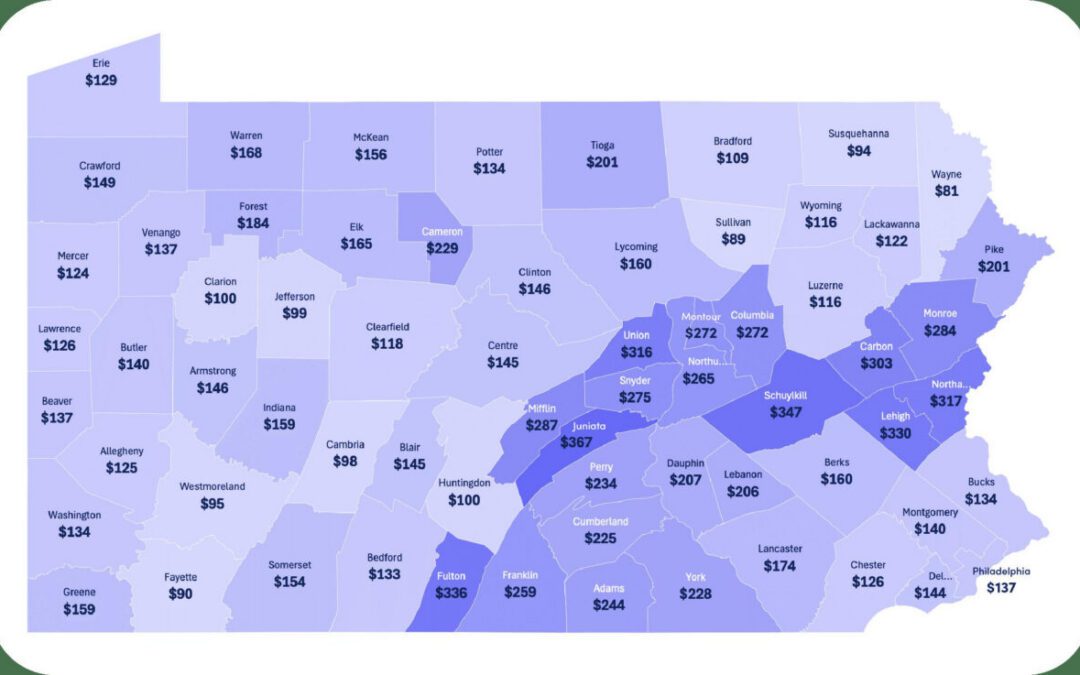

How much more are Pa. residents paying for ACA insurance

Pennsylvania's health care marketplace released data on average insurance cost increases in 2026 as media reports that Senate negotiations to...

This York County couple was hit with a 221% health insurance increase

Tom and Carol Shaw are both 63. Tom is retired – he worked for 16 years for Capitol Blue Cross – and Carol teaches project management, part-time, at...

One in 5 ACA enrollees in Pa. drops health coverage as costs spike

About 85,000 Pennsylvanians have dropped their Affordable Care Act coverage for 2026 in the face of soaring premium costs from the expiration of...

It’s 2026 and you’re uninsured. Now what?

It’s 2026, and you’re uninsured. Now what? Renuka Rayasam February 2, 2026 Health policy changes in Washington will ripple through the...