Rep. Brian Fitzpatrick, R-Pa. (AP Photo/Matt Rourke, File)

The collar county congressman objected to Medicaid cuts added by the U.S. Senate.

After weeks of debate, Republicans in Congress managed to pass a massive spending bill containing many of President Donald Trump’s domestic policy priorities.

Broadly, the bill includes a slew of tax cuts and increases to defense and immigration enforcement spending, which is partially paid for with cuts to safety net programs like Medicaid and food assistance. Still, the bill is projected to add more than $3 trillion to the country’s debt during the next decade.

Debate over the bill threatened to split the Republican caucus, with deficit-wary hardliners decrying its price tag and others warning of the impacts of cutting social services like Medicaid and food assistance. Ultimately, the final version of the bill passed mostly along party lines, with three Republican senators and two Republican House members joining every Democrat in opposing the final legislation.

The only Pennsylvania Republican to oppose the bill was Rep. Brian Fitzpatrick (R-01), a moderate representing the Philadelphia suburbs.

Fitzpatrick voted in favor of an earlier version of the bill that passed the House, but opposed the amended version that returned from the Senate. It included even steeper cuts to Medicaid than had already been proposed.

“I voted to strengthen Medicaid protections, to permanently extend middle-class tax cuts, for enhanced small business tax relief and for historic investments in our border security and our military,” Fitzpatrick said in a statement after the Thursday afternoon vote. “However, it was the Senate’s amendments to Medicaid, in addition to several other Senate provisions, that altered the analysis for our PA-1 community.”

The bill’s Republican defenders see it differently.

“This bill delivers on the promise I made to the people of Northeastern Pennsylvania by providing the largest working-class tax cuts in American history, eliminating taxes on tips and overtime and securing the southern border,” said Rob Bresnahan (R-08), who represents Northeast Pennsylvania. “We also protect and strengthen Medicaid by cracking down on the fraud, waste and abuse that is driving the program toward collapse. This ensures Medicaid is there for seniors, people with disabilities, and vulnerable families, not for those who can work but refuse to do so.”

According to an analysis of census data by KFF, a nonprofit focused on health policy research, 92% of Medicaid recipients under 65 are either working, attending school, or not working due to caregiving, illness or disability.

Nearly 12 million Americans could lose health insurance when the bill’s provisions take full effect, according to estimates from the nonpartisan Congressional Budget Office.

The Pennsylvania Department of Human Services estimated a previous version of the bill could have resulted in 310,000 Pennsylvanians losing Medicaid coverage, and another 270,000 losing access to government-backed Affordable Care Act plans because of the expiration of enhanced premium tax credits. The version of the bill that passed Thursday made even steeper cuts.

Primarily, Medicaid cuts are accomplished by implementing strict work requirements and reporting mandates. Medicaid recipients will have to prove they’re working or volunteering at least 80 hours a month if they are not children, elderly, disabled, seriously ill, in recovery or caretakers of children under 14. They will also have to certify their eligibility at least twice a year or risk losing benefits.

Previous efforts to implement similar work requirements in Georgia and Arkansas resulted in tens of thousands of people who should have qualified for the program becoming uninsured.

The bill also sets new limits on how much states can tax health care providers like hospitals to help pay for their Medicaid programs, reducing the top rate from 6% to 3.5% by 2032.

The Department of Human Services says the move could cost them $2.7 billion in tax revenue and federal matching funds when the change takes full effect.

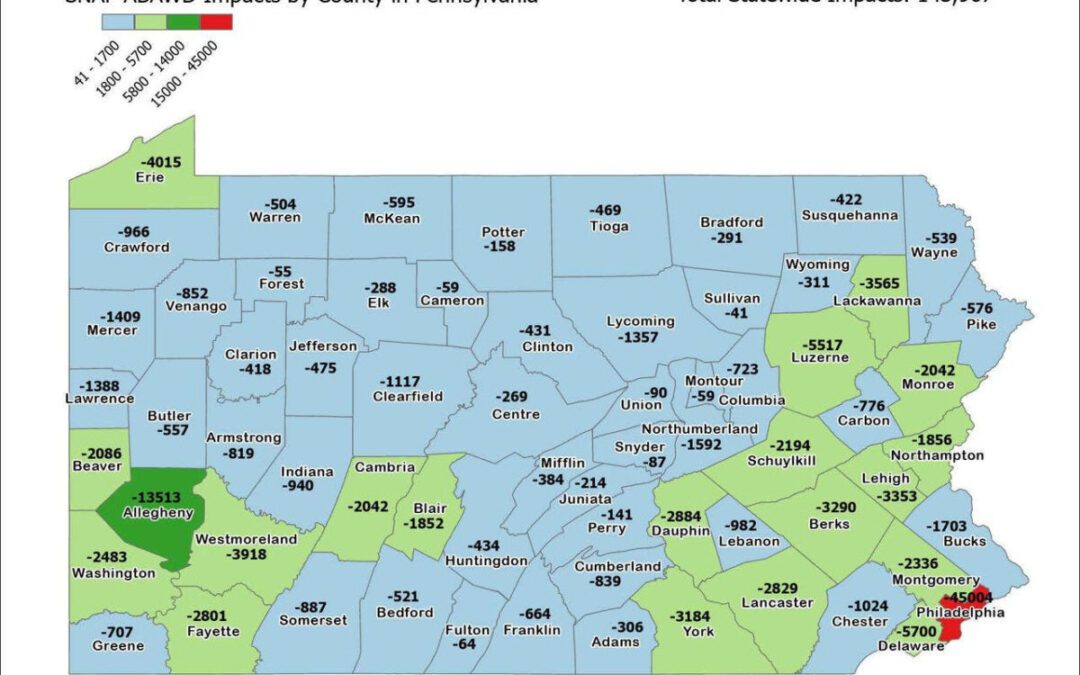

The bill also cuts the federal share of SNAP funding in some cases, shifting some of the burden of paying for the food assistance program to states for the first time. Alaska and Hawaii aside, states with error rates above 6% — meaning the frequency that they underpay or overpay recipients — will have to fund between 5% and 15% of the program themselves.

Pennsylvania’s error rate was 10.76% in 2024, slightly below the national rate of 10.93%

Gov. Josh Shapiro has said repeatedly in recent weeks that Pennsylvania does not have the money to make up for lost federal funds for safety net programs.

“Shame on these members of Congress who spent the last few months saying, ‘Oh, I’ll never cut Medicaid,’” Shapiro told WILK radio Thursday morning. “This is just crazy that they’re voting to knock poor people off of this assistance. Why? Because they wanted to give a huge tax cut to people at the highest income level.”

The cuts led to concerns about the financial impact on rural hospitals that rely on Medicaid dollars to stay afloat. To offset that, the Senate inserted a provision creating a $50 billion fund for them.

The biggest expenses in the bill are tax cuts. It extends the first Trump administration’s 2017 tax cuts that were set to expire; it makes good on Trump’s campaign promises to eliminate taxes on tips and overtime pay; it extends the child tax credit from $2,000 to $2,200; and it raises the SALT tax deduction cap, which allows people to deduct a portion of local taxes paid from their federal filings, from $10,000 to $40,000.

There are also new tax cuts for businesses that will allow them to write off additional expenses. However, many tax cuts for green energy projects passed under the Biden administration will be eliminated.

The bill includes $350 billion in new spending for national security and immigration enforcement, including $46 billion for a U.S.-Mexico border wall, $45 billion for migrant detention facilities and $30 billion for Immigrations and Customs Enforcement.

Another $25 billion will go towards developing a country-wide missile defense system Trump has referred to as the “Golden Dome,” named after Israel’s “Iron Dome” that was built with U.S. assistance.

The CBO estimated the version of the bill that passed the House primarily benefited the wealthiest Americans, while costing the poorest.

Factoring in cuts to safety net programs, the poorest 10% of households are expected to lose around $1,600 per year, while middle income households will gain between $500 and $1,000 and households in the top 10% of income levels will gain about $12,000 annually.

Despite his ultimate opposition, the Democratic Congressional Campaign Committee has already hammered Fitzpatrick for voting on the initial version of the bill. Then, it passed the House on a 215-214 vote, where a single flip could have held it up.

“Now, Fitzpatrick is trying to cover his tracks because he knows that his vote to advance massive cuts to Medicaid in order to fund tax cuts for billionaires will end his career, ” Eli Cousin, a DCCC spokesperson said in a statement.

While Fitzpatrick has held onto his seat since 2018, his district voted for Democratic nominee Kamala Harris in the 2024 election.

FBI analyzed phone records of Republican Pa. Congressman Mike Kelly as part of Trump Jan. 6 probe, lawmakers say

The FBI in 2023 analyzed phone records of more than a half dozen Republican lawmakers as part of an investigation into efforts by President Donald...

Fetterman’s approval rating is tanking among Democrats. Here are 4 reasons why

Young people helped elect Sen. John Fetterman in 2022, but now, they are his largest group of detractors according to a new poll. US Sen. John...

Will food stamps, SNAP, WIC benefits still go out in PA during government shutdown?

Pennsylvanians are expected to continue seeing Supplemental Nutrition Assistance Program payments in October despite the federal government...

‘An extra burden.’ Southwestern Pa. braces for SNAP benefit losses

The emergency assistance line keeps ringing for the United Way of Southwestern Pennsylvania. Over 47,000 calls through PA 211 have been made to the...

How could the federal shutdown affect Pennsylvania workers, parks, air travel?

As President Donald Trump and congressional Democrats clash over government spending, a partial government shutdown looms Oct. 1. Partisan spending...