Charlotte Hauer of Connellsville, right, has her vitals checked by medical assistant Courtney Breakion at Centerville Clinics Connellsville Medical and Dental Office on September 23, 2025, in Connellsville, PA.

Courtney Blocker, a 33-year-old from a southwestern Pennsylvania coal community, found out she’d lost her insurance coverage at a pharmacy counter while trying to replenish her supply of insulin.

Diagnosed with Type 1 diabetes as a child, Blocker relies on a pump to deliver a regular drip of the medication, risking life-threatening acid buildup in her bloodstream if she doesn’t have it. But with the each vial priced at up to $300, she can only afford the treatment through Medicaid, a government health insurance program for low-income Americans.

That day, about two years ago, the pharmacist told her the program had kicked her out.

“You have to have (insulin) to live,” she said. “They’re just like, ‘Oh, no, now you can’t get it.'”

The only way Blocker pulled through while she scrambled to re-enroll, she says, was by borrowing an insulin vial from a friend who also had diabetes.

Her issue was something of a fluke, related to a paperwork error at the county benefits office, she recalls. But health experts say millions across the U.S. could soon face a similar loss of coverage because of new hurdles created by the One Big Beautiful Bill, the massive tax package passed this year by congressional Republicans.

And they predict the fallout of President Donald Trump’s marquee bill will land particularly heavily on some of the very rural communities that put these GOP politicians in office.

Fayette County, where Blocker lives, is one of these places. In Pennsylvania, the once-prosperous coal mining hub trails only Philadelphia in its Medicaid enrollment rates, with almost a third of the county’s residents and more than half its children and youth depending on the program.

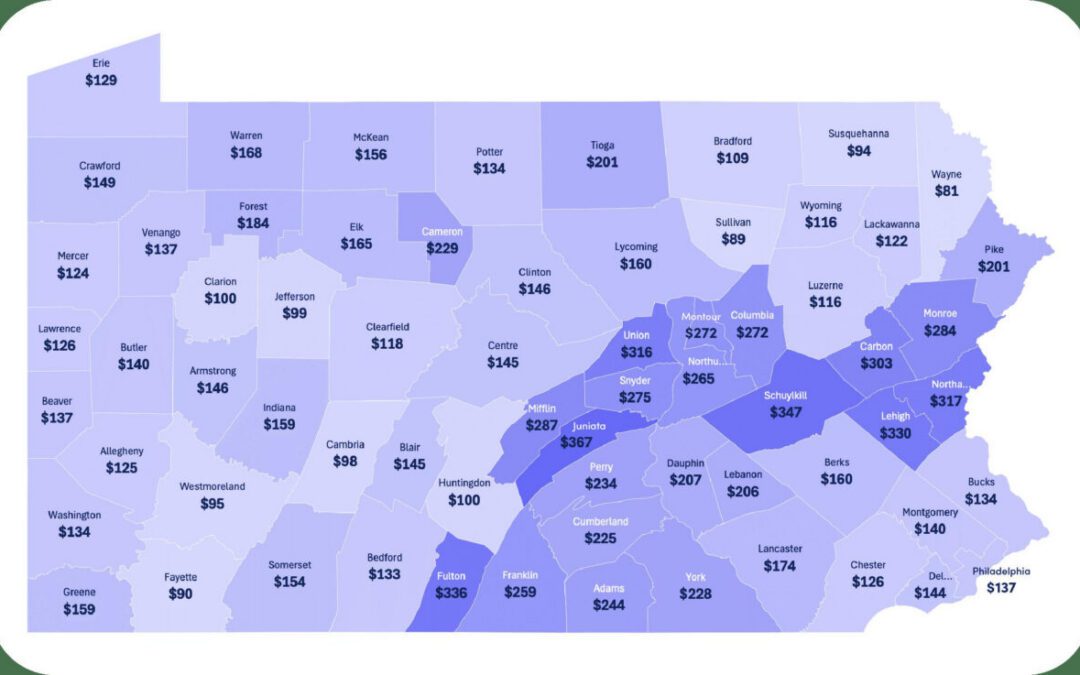

About a tenth of Fayette County’s Medicaid users, or 4,080 people, will lose their coverage because of forthcoming work requirements and other aspects of the “big beautiful” bill, state officials have estimated. This rise in uninsurance and projected drop of $50 billion in federal Medicaid funding in Pennsylvania over the coming decade could squeeze fragile health systems that have managed to survive in rural areas, advocates say.

Fayette County providers worry these cuts will set back wellness in an area that already ranks as one of the commonwealth’s least healthy, reporting higher rates of obesity, physical and mental distress and low-weight newborns than the rest of the state.

Richard Rinehart, who oversees several dental clinics in Fayette County, views the projected loss of coverage and health services as breaking a contract with the miners who built up this area, laboring in jobs that left them with black lung and other ailments.

“I think it’s a betrayal to the folks who are still living,” he said. “I think it’s a betrayal not to support their health care.”

Right-leaning policy advocates, though, say dropping Medicaid enrollment rates aren’t necessarily a bad thing, hoping that the impending work requirements and other measures will shift people to higher-quality private insurance plans.

Elizabeth Stelle, vice president of policy for the Commonwealth Foundation, also believes the coming changes are a chance to transform rural health networks that aren’t as robust as residents would like. Her group encourages deregulation and licensing reforms that she says would make it easier for mid-level providers to set up shop in these places.

“When we’re talking about protecting rural health and access for folks, we need to think broader than sending money,” she said. “We need to look more at how to really put the patient in charge.”

Why are Medicaid rates so high in Fayette County?

The closure of coal mines and steel mills in the 20th century sucked good-paying jobs out of southwestern Pennsylvania, where they were once abundant. There were some job retraining efforts in Fayette County, locals say, but many people still struggle to earn a living wage, and the county ranks as one of the commonwealth’s poorest.

More than half the county’s children and young adults are covered through the Medicaid program, and 17% of residents older than 65 are enrolled, according to state data.

Of the roughly 39,000 Fayette County residents who use the program, about a quarter are eligible thanks to Pennsylvania’s decade-old decision to expand Medicaid to low-income people of working age. These are the people who generally would have to comply with the new 80-hour-per-month work requirements attached to Trump’s tax bill, while older adults or recipients with disabilities would fall outside the mandate.

However, former Pennsylvania Rep. Matthew Dowling, a Republican who spent three terms representing Fayette County, said he’s concerned the exemptions aren’t expansive enough. A 2018 bill he sponsored would’ve imposed similar job mandates on the commonwealth’s Medicaid recipients, but it included carveouts for domestic violence survivors and other people “experiencing a crisis.”

“I think (work requirements) are a positive step,” said Dowling, whose proposal cleared the legislature but was vetoed by then-Gov. Tom Wolf. “But we can’t put people on the edge of a financial or health care cliff, like I worry that may be happening now.”

Advocates say many of the people who will lose insurance are working and would get kicked out simply because of the added paperwork burden and the likelihood that program administrators will make mistakes when processing it.

Stelle says this conclusion is based on unreliable survey data that suggests most of this population is already employed. She believes the requirements, which must kick in by 2027, will encourage able-bodied people to level up in their careers and secure private health plans that afford them superior coverage.

A job with health benefits isn’t always the answer, though, since some people can’t afford their plans because of low pay or can’t meet their health needs through the private plan, according to KFF.

That’s the position Blocker is in, as a full-time classroom behavioral therapist in a school for children with autism. Her employee insurance wouldn’t completely pay for her insulin, and she doesn’t make enough money to cover the balance.

She’s depended on Medicaid for much of her adult life, though she went through a time without coverage after getting dropped from her parents’ plan when she turned 26.

During that period, she scraped along by collecting free insulin samples from pharmaceutical representatives at her doctor’s office. Eventually, they told her they could no longer supply them.

“I remember one time … I was almost completely out of insulin,” she said. “And them telling me, ‘If it gets bad, you’re just going to have to go to the emergency room.’”

Since enrolling in Medicaid, she’s had affordable access to her life-sustaining treatments and now uses an insulin pump to regulate her blood-sugar levels rather than injecting herself a dozen times each day, as she once did. She says her health has “changed tremendously for the better.”

A nudge toward employment?

Supporters of the impending Medicaid changes say if able-bodied individuals are benefiting from expensive public assistance programs, it’s only fair to require regular eligibility checks and proof of employment. These checks don’t have to be burdensome, says Stelle, who argues the state’s task will be to design a simple, headache-free compliance system.

But even simple paperwork tasks can overwhelm people who are grappling with mental illness and cognitive problems, said Dave Rider, head of Fayette County’s behavioral health administration.

“Mental illness can be episodic, but boy, if the episode is in a time when they need to renew their eligibility for Medicaid, how tragic would that be?” he said.

Because of Medicaid expansion for low-income adults, nearly 3,600 people in Fayette County have access to behavioral health services they probably couldn’t otherwise afford, according to the state.

Getting this health insurance is often an important stepping-stone to gain employment, said Michael Quinn, CEO of Chestnut Ridge Counseling Services, a mental health provider in Fayette County. Many people need their Medicaid-covered care to remain functional enough for a job, he said, while others lean on psychiatric rehabilitation and vocational readiness programs to find work in the first place.

Access to routine physicals and dental care is also linked to stable employment, county health providers say.

“If you don’t have teeth in your mouth, chances are you’re not too hirable,” said Rinehart, of Cornerstone Care Community Health Centers, a federally funded safety net provider with sites in Fayette County.

But Rinehart estimated the projected Medicaid enrollment drops and spike in uninsured patients could cut his revenues by more than $1.5 million annually and compromise his clinic’s ability to offer dental care.

He said his centers might have to consider rationing dentures and root canals, services that actually cost them money. Many federally qualified health centers have stopped offering them altogether because of the expense, he said.

Cornerstone Care and Centerville Clinics, another federally funded organization with locations in Fayette County, would also likely have to shed staff or look at closing smaller sites to cope with lower Medicaid revenues, representatives said. Wait times for services, which are already months long for dental care, would likely increase even more.

These providers are doubtful it will save taxpayer money in the long run, either, saying uninsured people often let their health deteriorate because they can’t afford to see doctors and end up requiring more expensive, publicly funded care.

If additional holes start opening in the county’s safety nets, providers fear the outcome will be more emergency room visits, inpatient care and homelessness in a time when Fayette County is already seeing an uptick in unsheltered individuals. Last year’s annual homelessness census tallied 64 unhoused people in the county, the most since at least 2017.

“Health care is expensive,” Rider said. “And not providing health care is also expensive.”

‘Never gotten slammed this hard’

Penn Highlands Connellsville opened as a tiny, 38-bed facility in the 1890s, mainly intended to treat coal miners injured on the job.

Though it was state-owned for much of its history, the hospital was privatized in the 1970s as mining faded, and it has changed hands several times since then, the cloud of financial strain hanging over it. Most recently, in 2022, the Penn Highlands Healthcare system acquired the facility, and while it’s small compared to the county’s other hospital in Uniontown, it is still one of the community’s largest employers.

Marcy Ozorowski, who formerly worked in patient accounts at the facility, is proud that the hospital has kept its doors open through many financial challenges.

But there are signs of strain.

Ozorowski, who lost her job in 2025 after 41 years, said Penn Highlands cut positions at the Connellsville hospital in a consolidation effort, shifting those responsibilities to employees at other sites. While she understands the focus is on maintaining frontline care staff, these behind-the-scenes jobs also brought value to the county, she said.

“When your community is used to calling and saying, ‘Can you explain my bill to me,’ they want to come back when they know someone is treating them like family,” she said. “When you don’t have rural health care, you become more of a number.”

Erosion in Medicaid coverage would turn up the financial pressure on Penn Highlands Connellsville, according to a study recently commissioned by congressional Democrats. The review mentioned it as one of five Pennsylvania hospitals that might be imperiled by the passage of Trump’s tax bill and the ensuing drop in Medicaid enrollment.

Ozorowski said her hospital already loses hundreds of thousands of dollars annually providing health care to people who don’t have insurance and can’t afford to pay.

The Connellsville facility has weathered many storms in the decades of its existence, she said. This is the first time she fears it might not pull through.

“I always said we’d be OK,” she said. “But we’ve never gotten slammed this hard.”

The “big beautiful” bill’s changes are coming as the county strives to protect its health care services. The hospital in Uniontown recently reopened its labor and delivery unit after years when women had to leave the county to give birth in a hospital.

Ozorowski contends that having the facility in Connellsville, which is about 20 minutes from Uniontown, has saved lives. For someone who’s having a heart attack, she says, every minute counts.

Are people aware?

In June, Tracy Wilson, an activist with the Democratic Women of Fayette County, helped organize a community conversation about the effects of Medicaid cuts, inviting elected leaders, health care representatives, people in elder care and the public.

Social services workers voiced concern about how the changes might affect their clients. Children worried about their parents in nursing homes. Retired coal miners spoke about trying to scrape by on pensions and wondering where the cuts would leave them, she said.

Wilson said the stories were painful to hear, and they fuel her frustration that the county, a union stronghold that leaned Democratic during her childhood, has turned so solidly red.

“They’re voting against their own best interests,” Wilson said of GOP voters in Fayette County. “And they don’t even see it.”

Dowling said though tax cuts and other elements of the “big beautiful” bill will please Trump’s supporters, the Medicaid changes could anger parts of his base.

“We’re seeing some of the families that also would have conservative family values are the ones that are kind of on the chopping block as far as health insurance,” he said.

But for some enrolled in Medicaid, like Blocker, it’s not entirely clear what the downstream effects of the federal changes will be.

“I know, if I would lose this insurance, how much it would impact me,” she said. “I’d have to choose between paying my bills and getting my medications.”

Katelyn Heinbaugh, a Connellsville resident who has cystic fibrosis, said advocates for patients with the genetic disorder — which damages the lungs and other organs — have been sounding the alarm about the Medicaid cuts. However, like Blocker, she’s not sure how impending changes will touch her own life.

The 33-year-old relies on the program for access to a prescription drug, Trikafta, that would cost roughly $25,000 a month if she had to pay out of pocket. The medication has been transformative for her over the past five years, and she said this is the longest stretch she’s ever spent outside of a hospital, where she once needed admission about every six months.

But she sees this progress as somewhat fragile, dependent on the delicate web of benefit programs that support her care.

If cuts happen, she’s anxious that cystic fibrosis patients might be particularly vulnerable; the condition, though it can require lung transplants and used to kill people in childhood, isn’t as visible as many other disabilities, and she says it can be easier to dismiss. Also, the expensive treatments are financially out of reach for many families unless they have assistance, she said.

“This is going to cause huge issues, especially in the (cystic fibrosis) community,” Heinbaugh said of Medicaid reductions. “There’s no way for this to work for a lot of people without the help from the government.”

For her part, Heinbaugh is working on accumulating a small stockpile of her pills in case her health benefits get yanked away. Just enough, she said, to buy time to figure out a survival strategy.

One in 5 ACA enrollees in Pa. drops health coverage as costs spike

About 85,000 Pennsylvanians have dropped their Affordable Care Act coverage for 2026 in the face of soaring premium costs from the expiration of...

It’s 2026 and you’re uninsured. Now what?

It’s 2026, and you’re uninsured. Now what? Renuka Rayasam February 2, 2026 Health policy changes in Washington will ripple through the...

Two community hospitals in York County set to open this spring

Two new community hospitals in York County are expected to open in the spring, according to WellSpan's advertisements. One of the hospitals is just...

Report: Pa. hospitals face increasingly precarious financial future

Financial instability could force closures at more than a dozen Pennsylvania hospitals in the coming five years if state policymakers fail to act...

Pa. Pennie enrollment drops as Congress wrestles with health insurance subsidy vote

Some Pennsylvanians stay enrolled and pay tripled premiums with the hope lawmakers will vote to extend tax credits. Thousands of Pennsylvanians have...