Student debt relief advocates gather outside the Supreme Court on Capitol Hill in Washington, Tuesday, Feb. 28, 2023, ahead of arguments over President Joe Biden's student debt relief plan. (AP Photo/Patrick Semansky)

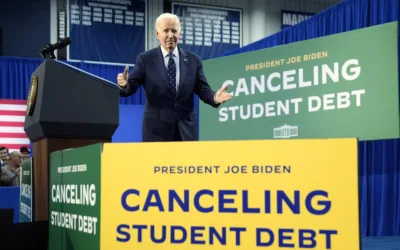

On Tuesday, the Supreme Court is hearing arguments on President Biden’s student loan cancellation plan—specifically, whether six states with Republican attorneys general have the right to sue the federal government to block it.

In Aug. 2022, delivering on a campaign promise, Biden announced his plan to cancel student debt via executive order. His plan calls for $10,000 in federal student debt to be canceled for those who went to college and earned less than $125,000 (or $250,000 for a married couple) in 2020 or 2021. It also calls for $20,000 in debt to be canceled if you went to college, received Pell Grants (a form of federal financial aid for undergraduate students), and meet the income threshold.

For borrowers who have less than $10,000 in debt left, the remaining balance would be wiped out. In October, the US Department of Education began accepting applications for student debt relief, and 26 million borrowers applied for relief.

The administration estimates that nearly 90% of the 45 million student loan borrowers in the United States would qualify for some relief, and that 18 million would have their debts fully canceled. Sixteen million applications have been approved and sent to loan servicers to be discharged when allowed by the courts, and the White House claims that about 90% of the benefits will go to families earning less than $75,000.

The six states suing over the plan—Arkansas, Iowa, Kansas, Missouri, Nebraska, and South Carolina—say that the president’s plan is an abuse of executive authority. They also claim that other Americans will have to “pick up the tab” to make up for the money not coming in from repayments, though that same logic could be applied to any policy that reduces government revenue, including the Republican Party’s 2017 tax cut, which overwhelmingly benefited corporations and the very rich.

The Court is also hearing arguments in a second lawsuit, filed by two plaintiffs, Myra Brown, and Alexander Taylor. Brown holds “more than $17,000” in private loans, while Taylor owes $35,000 in federal loans, according to court filings. Brown is arguing that Biden’s plan harms her because she won’t benefit from it personally, while Taylor says it harms him because he will only get $10,000 forgiven and not the full $20,000, since he didn’t get a Pell grant. They also claim they were improperly denied the right to formally comment on the debt relief plan before it was unveiled.

They are backed by a conservative advocacy group known as the Job Creators Network Foundation. Brown, it’s worth noting, has filed the lawsuit even though her company had a $48,000 federal loan forgiven through the Paycheck Protection Program during the pandemic.

The White House has consistently insisted that its approach is legally sound, and the plan will prevail. In Nov. 2022, Education Secretary Miguel Cardona issued a statement saying that the administration strongly believes that the plan is “lawful and necessary to give borrowers and working families breathing room as they recover from the pandemic and to ensure they succeed when repayment restarts.”

In a more recent legal filing, the administration claims that the actions that President Biden has directed Secretary Cardona to take “fall comfortably within the plain text” of the 2003 Heroes Act, which allows the education secretary to grant relief in times of national emergency, such as a pandemic.

White House Press Secretary Karine Jean-Pierre has also said that the Biden administration is confident in its legal authority and will not stop fighting to “help working and middle-class Americans get back on their feet.”

Hundreds of borrowers rallied outside the Supreme Court on Tuesday; the case has galvanized labor unions, civil rights organizations, and youth activists in support of Biden’s plan.

“For too long the student debt crisis has exacerbated racial and economic inequality,” the Campaign to Cancel My Student Debt said in a statement. “Working people are looking to SCOTUS to follow the letter of the law and uphold critical relief for millions of student loan borrowers.”

The student loan collection system has been frozen for nearly three years, since the COVID-19 pandemic began. President Donald Trump initiated the hiatus as a two-month pause in March 2020, when the pandemic first began ravaging the US economy. Between Trump and Biden, the pause has been extended nine more times, most recently in November. The president announced then that borrowers’ payments would resume 60 days after the court challenges to his relief plan were resolved, but no later than the end of August.

While the legal battle over Biden’s cancellation plan has worked its way through the courts, his administration has pursued other avenues to help struggling borrowers.

The Biden administration has overhauled the Public Service Loan Forgiveness program, which allows some nonprofit and government workers to have their federal student loans canceled after a decade, or 120 payments. The program was plagued by issues for years, but the Biden administration implemented changes that have allowed nearly 360,000 borrowers to qualify for $24 billion in loan cancellations, according to Education Department data analyzed by higher education expert Mark Kantrowitz.

In January, the Education Department introduced a new income-linked repayment plan that would sharply reduce payments for many borrowers in the future. The agency is also working on a waiver program to be implemented this summer that would help millions of borrowers seeking to have their loans eliminated through the Public Service Loan Forgiveness Program and through the use of income-driven repayment plans.

The Biden administration has furthermore introduced a “fresh start” program for seven million borrowers who have defaulted on their loans, allowing them the opportunity to restore their loans to good standing and sign up for income-driven repayment plans they can afford. The program would also remove the record of a borrower’s default from their credit report.

The Court is expected to issue a ruling on Biden’s plan between now and mid-June.

Depending on when a decision comes, borrowers could resume payments as early as this spring, or as late as this fall.

“If the court issues a ruling a few weeks after the Feb. 28 hearing, repayment could restart in May or June,” higher education expert Mark Kantrowitz told CNBC. “If they wait until the end of the term in June or July, then there’d be an August or September restart.”

For Rep. Susan Wild, supporting PA families includes reproductive rights and much more

Rep. Susan Wild wants to be very clear with Pennsylvanians: Donald Trump is committed to taking away women’s reproductive freedom, but he is not...

School districts working with anti-LGBTQ groups can cost your kids’ schools millions

Parents across South Central Pennsylvania are worried about the potential financial impacts working with anti-LGBTQ groups may have on their school...

Opinion: Harrisburg Republicans’ Budget Surplus Flip-Flop Reveals True Priorities

Harrisburg Republicans have spent years honing a simple political strategy that could be described as oppose, pander, and negotiate in bad faith....

Central PA school board director cancels himself over gay guest speaker fallout

The Cumberland Valley School Board director resigned in protest on Monday after the board voted to reinstate Maulik Pancholy. The board originally...

New book details how Dave McCormick profited from 2008 financial crisis

Dave McCormick forged a relationship with Ray Dalio, the founder of Bridgewater Associates, in early 2008 and was rewarded with a job at Bridgewater...