Health insurance premiums for Highmark and UPMC Health Plan are expected to increase significantly in 2026, according to rates approved by the Pennsylvania Insurance Department.

Greg Deemer, whose job is to help Erie-area individuals and small businesses purchase health insurance, has been telling clients for months to prepare for significantly higher premiums in 2026.

The Pennsylvania Insurance Department confirmed Deemer’s prediction this week when it published the approved Affordable Care Act rates for health insurers selling plans in the state.

Plans for small groups of 50 or fewer employees will increase an average of 12.7%, while individual plans will rise an average of 21.5% — not including the elimination of any federal tax credits.

“We have known for a while that 2026 would be bad,” said Deemer, president of Bayfront Benefit Solutions. “Claims are higher and the popularity of GLP-1 drugs, think Ozempic, have raised costs.”

Open enrollment for individual health insurance plans starts Nov. 1 on Pennie, the state’s official health insurance marketplace, while many employers will select their 2026 plans by Dec. 1.

Final 2026 rates will depend on the specific plan and, for small and large employers, their history of claims and other specific factors. But most people will be paying much more for health insurance in 2026, Deemer said.

In northwestern Pennsylvania, Highmark and UPMC Health Plan are the two predominant commercial health insurers.

“Our 2026 ACA rates reflect the rising medical and pharmacy costs of our Pennsylvania members, unprecedented inflationary pressures on unit costs for medical procedures, high utilization rates and pent-up demand for care after the pandemic, and the expiration of enhanced premium tax credits,” Highmark officials said in a statement.

UPMC Health Plan officials referred all questions to the Insurance Federation of Pennsylvania, a nonprofit trade association of non-Blue Cross Blue Shield health plans.

“It’s safe to say that utilization costs are up, the cost of care is up and the leading factor for the rising cost of care is the cost of prescription drugs,” said Jonathan Greer, the federation’s CEO.

Highmark, UPMC Health Plan rates to rise an average of 8% to 25%

Here are the approved individual plan rate increases for both insurers:

- Highmark — 17.75%

- Highmark Benefits Group — 18.37%

- Highmark Coverage Advantage — 14.48%

- UPMC Health Options — 20.18%

- UPMC Health Plan — 24.78%

Here are the small group plan rate increases for both insurers:

- Highmark — 14.64%

- Highmark Benefits Group — 15.64%

- Highmark Care Benefits — 21.85%

- Highmark Coverage Advantage — 15.95%

- Highmark Senior Health Company — 12.26%

- UPMC Health Benefits — 6.54%

- UPMC Health Options — 8.88%

- UPMC Health Plan — 8.22%

“For individual plans, we will know Nov. 1 what the cost is for each specific plan offered by Highmark and UPMC Health Plan,” Deemer said. “You could see one basic plan increase by 10% and a premium plan increase by 30%, we just don’t know right now.”

Rates for Obamacare plans will be unveiled Nov. 1 on Pennie

Many, but not all, businesses have health insurance plans that renew Jan. 1 and will learn their new rates in the next several weeks.

Some individuals and employers may choose to reduce costs by selecting a health plan with reduced coverage and lower premiums. The drawback is that this could lead to higher out-of-pocket expenses for both employer and employee.

Adding to the confusion is the battle in Washington, D.C., over whether to extend the enhanced premium tax credits for plans on Pennie and other exchanges. Those enhanced credits are set to expire Dec. 31 though the basic tax credits will continue into 2026.

“I believe, and this is only my opinion, is that they will find a way to extend the enhanced premium tax credits for at least one year,” Deemer said. “I’m telling people not to panic until Nov. 1.”

Patients at Pa. hospitals fight DOJ’s demand for gender-affirming care records

University of Pittsburgh Medical Center and Children’s Hospital of Philadelphia received subpoenas in June. Families of children who received...

Trump officials warn pregnant women about Tylenol. Western Pennsylvania doctors offer second opinion

Dr. Devon Ramaeker, who treats women with some of the highest-risk pregnancies in western Pennsylvania, has advice for those who are concerned about...

Pennsylvania’s autistic lawmakers condemn Trump-Kennedy approach to the disorder

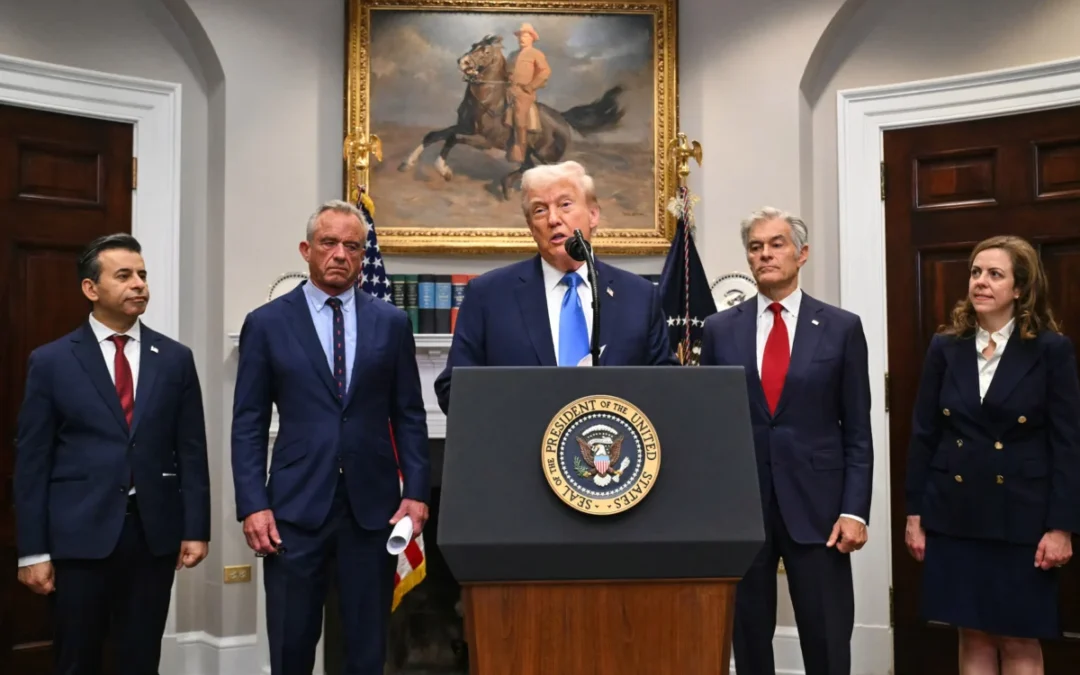

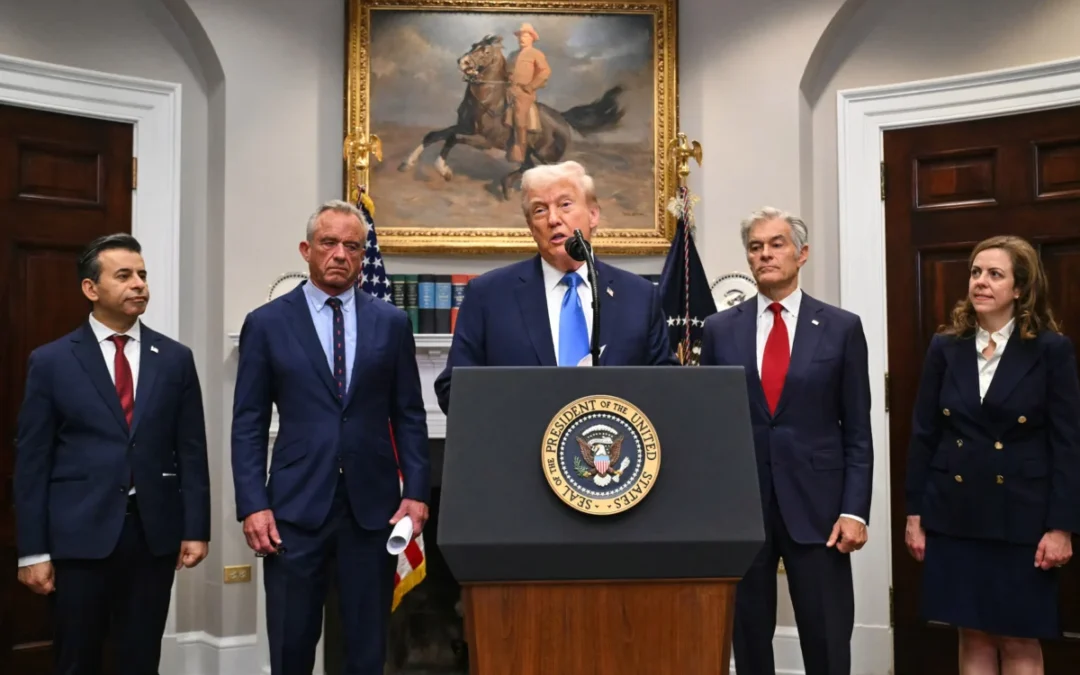

On Monday, President Donald Trump and Health and Human Services Secretary Robert F. Kennedy Jr. held a press conference claiming a link between...

University of Pennsylvania autism expert disputes Trump’s unfounded claims linking Tylenol and autism

President Donald Trump on Monday used the platform of the presidency to promote unproven and in some cases discredited ties between Tylenol,...

Fighting a health insurance denial? Here are 7 tips to help

By: Lauren Sausser When Sally Nix found out that her health insurance company wouldn’t pay for an expensive, doctor-recommended treatment to ease...