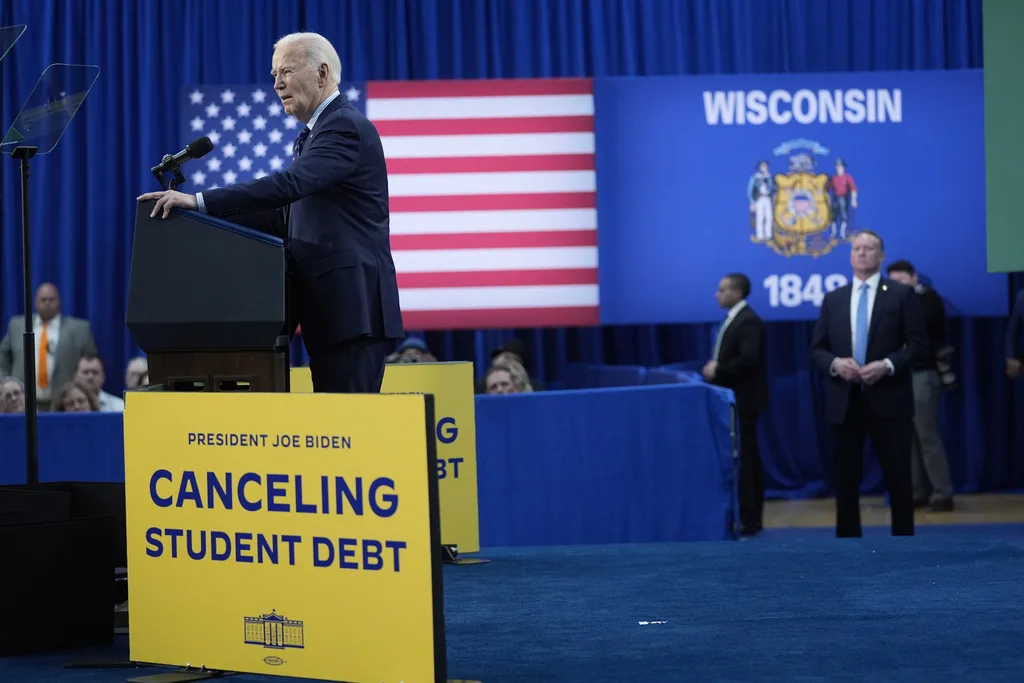

President Joe Biden delivers remarks on student loan debt at Madison College, Monday, April 8, 2024, in Madison, Wis. (AP Photo/Evan Vucci)

The Biden-Harris Administration on Monday unveiled new plans to relieve student debt for more than 30 million borrowers.

During appearances across the country, President Joe Biden, Vice President Kamala Harris, Second Gentleman Doug Emhoff, and Secretary of Education Miguel Cardona announced the administration’s efforts to build on existing debt relief programs and expand access to financial forgiveness.

Biden’s plan would provide relief to borrowers who owe significantly more than they originally borrowed due to accrued interest; borrowers who have been paying for at least 20 or 25 years; those who are eligible for existing cancellation programs but never applied; those suffering financial hardship; and those who attended low-value career-training schools that left graduates with high debt loads or low earnings.

“By freeing millions of Americans from this crushing debt of student debt, it means they can finally get on with their lives instead of their lives being put on hold,” Biden said during an appearance in Madison, Wisconsin.

While Republicans celebrated the Supreme Court blocking Biden’s original comprehensive student debt relief plan last June, the president has continued to prioritize loan forgiveness and access to higher education. Since 2021, more than 4 million Americans have been approved for $146 billion in student debt relief by way of over 24 executive actions. Biden has also worked to increase Pell Grant funding at the highest rate in over a decade, offering a path to college for low-income Americans.

“We continue to find alternatives to pass reduced student debt payments that are not challengeable,” Biden said.

New plan forgives interest, builds on existing debt relief programs

For borrowers who now owe more than they originally borrowed due to unpaid interest—some 25 million Americans, regardless of income—Biden’s new plan would cancel up to $20,000 of the amount a loan balance has grown. Benefits could extend beyond the $20,000 cap for low and middle-income Americans making $120,000 or less as a single borrower or $240,000 or less while married. For these borrowers, their balance growth due to interest would be canceled entirely and automatically—no application process necessary—if enrolled in an income-driven repayment plan.

If implemented, Biden’s new student debt relief plan would also build upon existing initiatives like the Saving on a Valuable Education (SAVE) plan and the Public Service Loan Forgiveness (PSLF) program, paving the way for even more Americans to qualify for loan forgiveness.

Since it took effect last summer, more than 8 million borrowers have enrolled in SAVE, which Biden called “the most affordable repayment plan ever.”

SAVE prevents balance growth due to unpaid interest, slashes payment rates for undergraduate loans in half, and even allows borrowers to reach $0 monthly payments to more quickly qualify for debt forgiveness. StudentAid.gov explains that SAVE “decreases monthly payments by increasing the income exemption from 150% to 225% of the poverty line.”

“For example, 225% of the Poverty Guideline amount for a family size of one (in the 48 contiguous states) is $32,800, which means that if your annual income is equal to or less than $32,800 and your family size is just yourself, your discretionary income is $0 and your monthly payment will be $0,” an info sheet on the site continues. “The same is true for a family size of four with an annual income of $67,500 or less.”

The new relief plan would use existing data from the Department of Education to identify qualified borrowers under programs like SAVE and automatically forgive their debt—even if they haven’t followed through with paperwork or other former enrollment requirements.

For debt forgiveness under SAVE, borrowers need to have taken out at least $12,000 in initial loans and have been in repayment status for at least a decade. For each additional $1,000 taken out, borrowers must have been in repayment for one additional year. For example, a loan of $13,000 must have been in repayment for at least 11 years.

Under PSLF, borrowers employed in the public service sector for at least a decade qualify for full loan forgiveness, so long as they’ve made 120 months’ worth of qualifying payments. Prior to Biden’s restructuring, the program had been in place for 15 years, but had provided debt relief to just 7,000 applicants.

Under the current administration’s improvements, more than 900,000 public service workers—including firefighters, teachers, and nurses—have enjoyed debt relief through PSLF.

Plan includes considerations for racial disparities, financial hardship

The White House says Monday’s announcement also specifically addresses what it calls a “disproportionate debt burden on borrowers of color and other vulnerable borrowers,” pointing to racial disparities in loan repayment rates for Black and Latino borrowers and disproportionate enrollment levels in “low-value” or for-profit colleges among Black students.

The plan includes special considerations for graduates of those “low-value” or defunct educational institutions. Borrowers with debt tied to schools like ITT Technical Institute and Corinthian Colleges, many of which lost eligibility to participate in federal student aid programs or resulted in poor job prospects for students after graduation, would be granted loan forgiveness.

A statement from the White House says this includes “borrowers who attended institutions or programs that closed and failed to provide sufficient value—for example [programs] that leave graduates with unaffordable loan payments or earnings no better than what someone with a high school diploma earns—would be eligible for relief under this proposal.”

Long-time debt holders would also benefit under the proposed relief plan. Biden’s outline includes debt cancellation for borrowers who entered the repayment period more than 20 years ago but never received appropriate income-driven relief. To qualify, borrowers would need to have entered repayment on undergraduate loans on or before July 1, 2005. For graduate program debt, borrowers would need to have entered repayment on or before July 1, 2000—25 years ago.

Finally, Biden’s updated student debt forgiveness plan would offer breathing room to low-income families or those facing financial hardships that might stand in the way of loan repayment. Borrowers experiencing significant barriers, from exorbitant medical bills to high child care costs, would be directly addressed in a finalized version of the plan.

“We’re giving people a chance to make it. That’s why I’ve never been more optimistic about our future,” Biden said of his administration’s efforts to alleviate debt. “We just have to remember who we are.”

If implemented, new student loan relief programs could benefit borrowers as soon as this fall.

For Rep. Susan Wild, supporting PA families includes reproductive rights and much more

Rep. Susan Wild wants to be very clear with Pennsylvanians: Donald Trump is committed to taking away women’s reproductive freedom, but he is not...

School districts working with anti-LGBTQ groups can cost your kids’ schools millions

Parents across South Central Pennsylvania are worried about the potential financial impacts working with anti-LGBTQ groups may have on their school...

Opinion: Harrisburg Republicans’ Budget Surplus Flip-Flop Reveals True Priorities

Harrisburg Republicans have spent years honing a simple political strategy that could be described as oppose, pander, and negotiate in bad faith....

Biden administration cancels $45.1 million in student debt for Pennsylvania residents

Another 5,600 Pennsylvania residents saw $45.1 million in student loan debt canceled by the Biden administration last week. Borrowers were enrolled...

Biden proposes new student debt relief plan for Pennsylvania borrowers facing ‘hardship’

The Biden administration on Thursday announced its latest proposal for widespread student loan cancellation that could provide relief to millions...