US Treasury Under Secretary for International Affairs David McCormick speaks during a press conference as part of the G-20 Finance Ministers and Central Bank Governors' Meeting, in Sao Paulo, Brazil, on November 9, 2008. (NELSON ALMEIDA/AFP via Getty Images)

Dave McCormick forged a relationship with Ray Dalio, the founder of Bridgewater Associates, in early 2008 and was rewarded with a job at Bridgewater after Dalio made $780 million on the financial collapse.

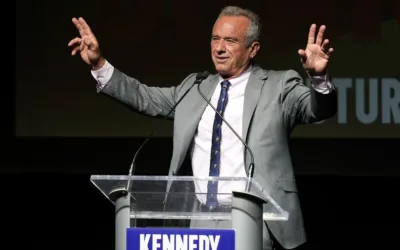

Much like his upbringing, Dave McCormick, the Republican challenger for US Senate in Pennsylvania, can attribute his wealth and his career as the president and CEO of the world’s largest hedge fund to being in the right place at the right time.

McCormick served as the president of Bridgewater Associates, the world’s largest hedge fund, from 2009, when working Pennsylvanians were reeling from the financial collapse, to 2020, and served as its CEO from 2020 to 2022.

A recent book, titled “The Fund” by Rob Copeland, is a biography that focuses on Ray Dalio’s rise as the founder of Bridgewater Associates.

It also shines a spotlight on how McCormick got rich thanks to the proverbial revolving door and his friendship with Dalio while he was serving as the Undersecretary of the Treasury for International Affairs in 2008.

“When you look at something like the recession, where millions and millions of people lost their pensions or were severely hurt, millions lost their jobs and to hear that someone benefited during that time, it’s heartbreaking,” Darrin Kelly, President of the Allegheny/Fayette County Labor Council, said in in an interview.

McCormick began working under former Treasury Secretary Henry Paulson in 2007 and went to Bridgewater Associates in 2009.

During this time, Copeland explained in his book that McCormick met with Dalio multiple times in early 2008 when Dalio predicted an impending financial crisis, and at these meetings Dalio was encouraging McCormick and other officials from former President George W. Bush’s administration and the Treasury to print money in order to stave off a financial crisis.

Once the great recession started, the federal government would heed Dalio’s advice and print trillions of dollars throughout the end of 2008.

According to Copeland, Dalio was betting against the dollar by investing in gold, treasury bonds and commodities as the government was pumping trillions of dollars into the struggling economy in the fall of 2008.

“While Bridgewater’s automated trading systems were positioned relatively conservatively, in 2007 and 2008 Dalio himself ordered a number of manual adjustments so the fund would profit more heavily from an overall decline, investment staffers there then recall. Throughout this period, he had placed a series of bets that would pay off if central bankers printed money to revive the economy—the exact move he had predicted,” Copeland wrote in the book.

Dalio made $780 million dollars in 2008 as Bridgewater Associates’ Alpha fund saw a 9% increase. Other hedge funds were witnessing 20% losses during that time.

Dalio then rewarded McCormick by hiring him as Bridgewater Associates’ president in 2009. McCormick would then go on to earn $21 million in 2021 as the hedge fund’s CEO.

To put things into perspective, over 191,000 Pennsylvanians lost their jobs in 2008 and 2009 and the state’s unemployment rate peaked at 9.3% in October 2010. Home foreclosures in the state skyrocketed by 173% during that time, and over 44,000 properties were foreclosed on in 2009.

All of this happened while McCormick began working at Bridgewater Associates.

“You look at it right now, there are still pension funds that have not gotten fully back. There are hundreds and hundreds of thousands of union members whose pensions were literally wiped out or were taken to the point where they’re still not back. People are still struggling from that day,” Kelly said.

The Philadelphia Inquirer reported in 2022 that McCormick and his wife, Dina Powell, a Goldman Sachs executive, are worth between $116 million to $290 million, and possibly more.

McCormick lived in Connecticut while working for Bridgewater, and the Associated Press reported that he rents a $16 million mansion on Connecticut’s “Gold Coast,” one of the densest concentrations of wealth in the country. The mansion includes a 1,500-bottle wine cellar, an elevator and a private beachfront resort overlooking the Long Island Sound.

McCormick’s wealth and lavish lifestyle are already focal points in his upcoming campaign against US Sen. Bob Casey.

Casey is campaigning on a progressive economic platform that includes supporting unions, going after junk fees and going after corporations for price gouging during and after the pandemic.

Casey is also using his opponents out of state residence and wealth whenever he gets a chance to on the campaign trail.

“He doesn’t live in Pennsylvania. He lied about living in Pennsylvania. We know that, and he continues to try to make that case that he’s living here,” Casey said to supporters in Lancaster last month.

“So here’s a candidate who’s an out-of-state candidate being supported by out of state billionaires. We don’t want a senator like that.”

Support Our Cause

Thank you for taking the time to read our work. Before you go, we hope you'll consider supporting our values-driven journalism, which has always strived to make clear what's really at stake for Pennsylvanians and our future.

Since day one, our goal here at The Keystone has always been to empower people across the commonwealth with fact-based news and information. We believe that when people are armed with knowledge about what's happening in their local, state, and federal governments—including who is working on their behalf and who is actively trying to block efforts aimed at improving the daily lives of Pennsylvania families—they will be inspired to become civically engaged.

Central PA school board director cancels himself over gay guest speaker fallout

The Cumberland Valley School Board director resigned in protest on Monday after the board voted to reinstate Maulik Pancholy. The board originally...

18,000 PA residents who attended the Art Institute have student loans forgiven

The Biden administration announced last week they were forgiving student loans for 317,000 borrowers who attended the Art Institute. This will help...

Rep. Mike Kelly benefits from Inflation Reduction Act after voting against it

Congressman Mike Kelly was an outspoken critic of President Joe Biden’s climate change legislation but that didn’t stop him from using solar credits...

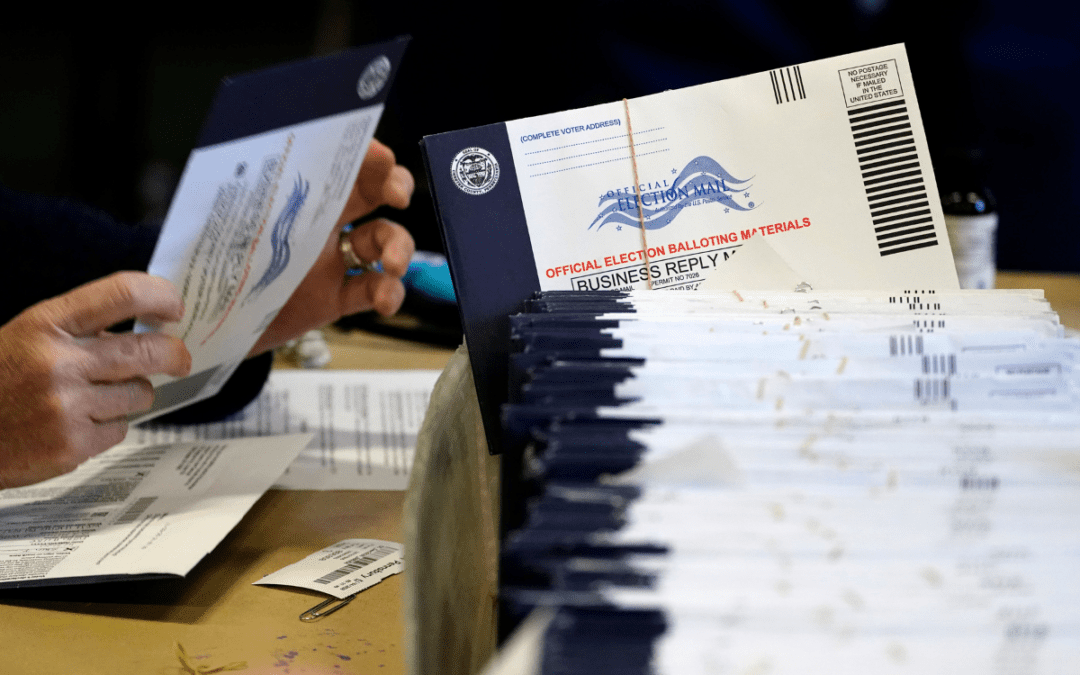

Pennsylvania redesigned its mail-in ballot envelopes amid litigation. Some voters still tripped up

HARRISBURG, Pa. (AP) — A form Pennsylvania voters must complete on the outside of mail-in ballot return envelopes has been redesigned, but that did...

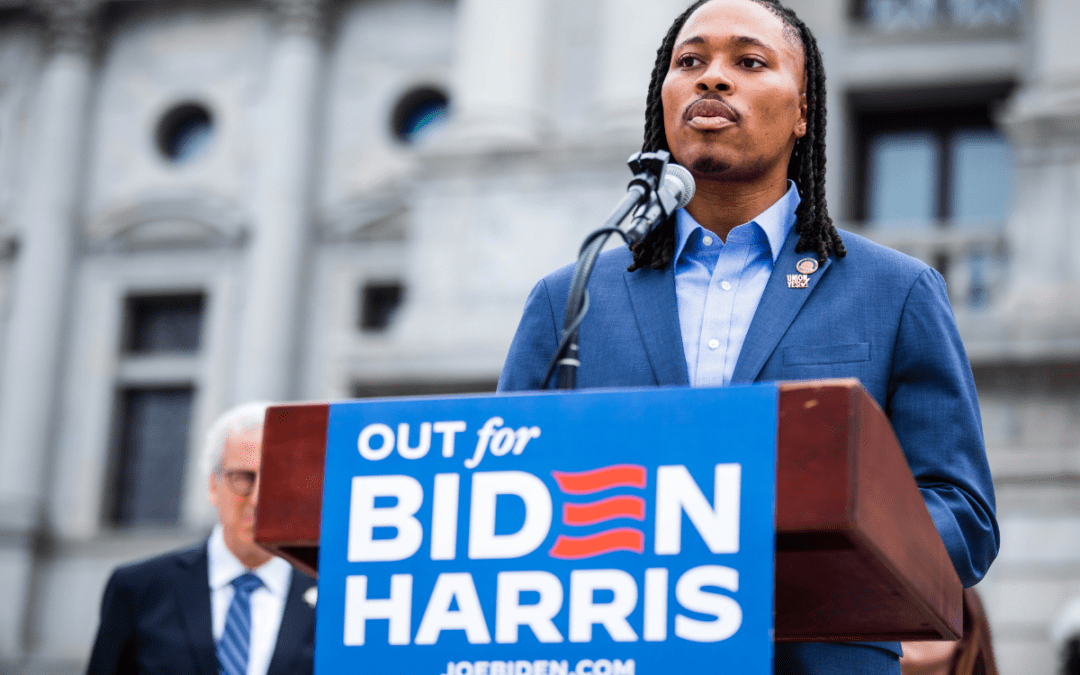

Malcolm Kenyatta makes history after winning primary for Pa. Auditor General

State Rep. Malcolm Kenyatta, who was first elected to the state House in 2018, won the Democratic nomination for Pa. Auditor General and will...