Members of the Eastern Atlantic States Regional Council of Carpenters holding a "tax fraud" banner in the Pennsylvania State Capitol in Harrisburg on April 15, 2024. (Photo: Sean Kitchen)

The Tax Day action brought members of the Carpenters union to Harrisburg to raise awareness of worker misclassification and wage theft in the construction industry.

Close to 100 members of the Eastern Atlantic States Regional Council of Carpenters filled the rotunda stairway at the Pennsylvania State Capitol on Monday to highlight worker misclassification and tax fraud carried out by contractors across the commonwealth.

They gathered in Harrisburg for Tax Day and were joined by House lawmakers, Department of Labor and Industry (L&I) Secretary Nancy Walker and Delaware County District Attorney, and Democratic candidate for Attorney General, Jack Stollsteimer.

“Worker misclassification is not only morally wrong. It is a crime in Pennsylvania,” Stollsteimer said at Monday’s press conference.

“When I took office four years ago, I sat down with Attorney General Josh Shapiro and his chief deputy at that time, Nancy Walker, and we held contractors accountable. We put together a task force. We did investigations. Four contractors have been held criminally liable for misclassifying their workers, for stealing from them, from stealing from us as taxpayers and they have even gotten jail time.”

Worker misclassification and the wage theft that comes along with it runs rampant in the construction industry because it incentivizes business owners to steal money from their employees and taxpayers to pad profits. These jobs are also some of the deadliest in the country.

A 2019 report by the Keystone Research Center, a progressive economic think tank based in Harrisburg, estimates that misclassifying construction workers in Pennsylvania saves as much as $200 million a year in federal taxes, $83 million in unemployment compensation taxes, $47 million in state income taxes and $11 million in unemployment compensation taxes.

However, those estimates were based on worker misclassification reports in states from the early 2000’s and those figures may ever be higher than previously thought.

If Pennsylvania wants to curb worker misclassification in the construction industry, the state would need to hire an adequate amount of investigators.

There are only 27 investigators in Pennsylvania that are responsible for enforcing 13 labor laws across 67 counties, while New Jersey, which has 70% of the population of Pennsylvania, has 70 investigators. Gov. Josh Shapiro has requested an additional $1.2 million in funding for Labor and Industry’s labor law enforcement.

This year, the Department of Labor and Industry found that 4,200 workers have already been misclassified and cost them close to $1 million in unpaid unemployment compensation taxes.

Walker explained that if a worker is hurt on the job or is laid off and the employer hasn’t paid unemployment compensation taxes, that worker is unable to collect those benefits.

She also pointed out that the tax burden is shifted to other businesses or taxpayers when companies engage in these illegal practices.

“Things like fire, police, emergency medical services, parks, recreation facilities,” Walker said on Monday. “They are not being paid by way of these contractors that refuse to pay wage taxes.”

Politics

Bob Casey warns about Supreme Court’s attacks on workers and unions

US Sen. Bob Casey is warning Pennsylvania voters that the US Supreme Court is coming for the right to organize. Corporate greed and workers’ rights...

Community pushback gets school board to rescind decision on denying gay actor’s visit

Cumberland Valley School Board offered a public apology and voted to reinstate Maulik Pancholy as a guest speaker a week after the board voted to...

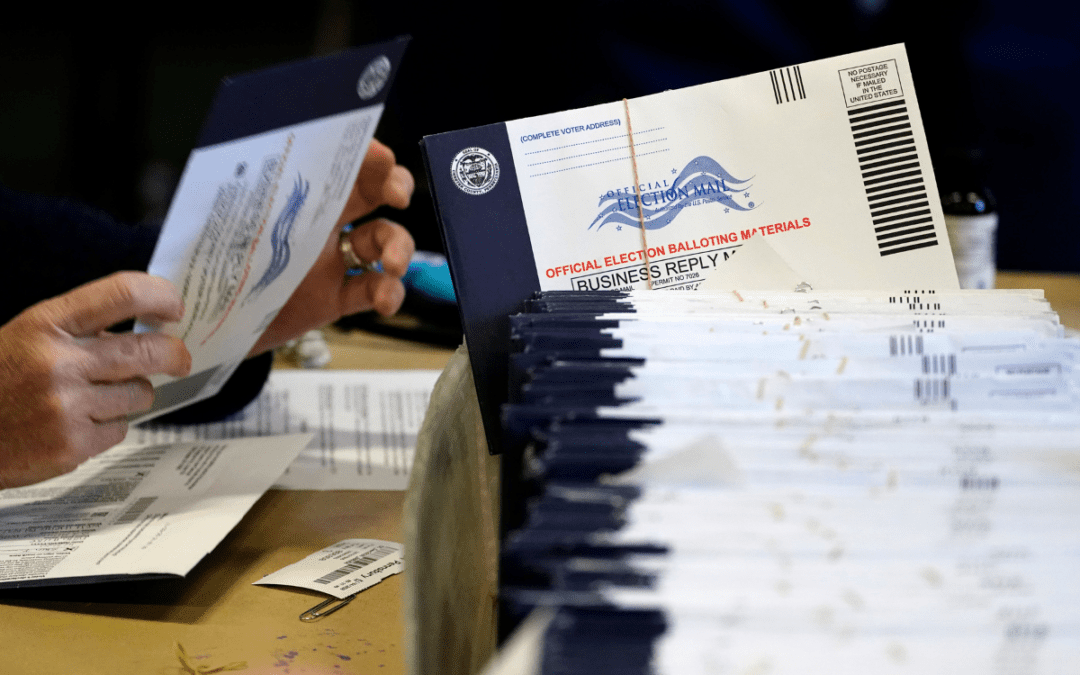

Pennsylvania redesigned its mail-in ballot envelopes amid litigation. Some voters still tripped up

HARRISBURG, Pa. (AP) — A form Pennsylvania voters must complete on the outside of mail-in ballot return envelopes has been redesigned, but that did...

Local News

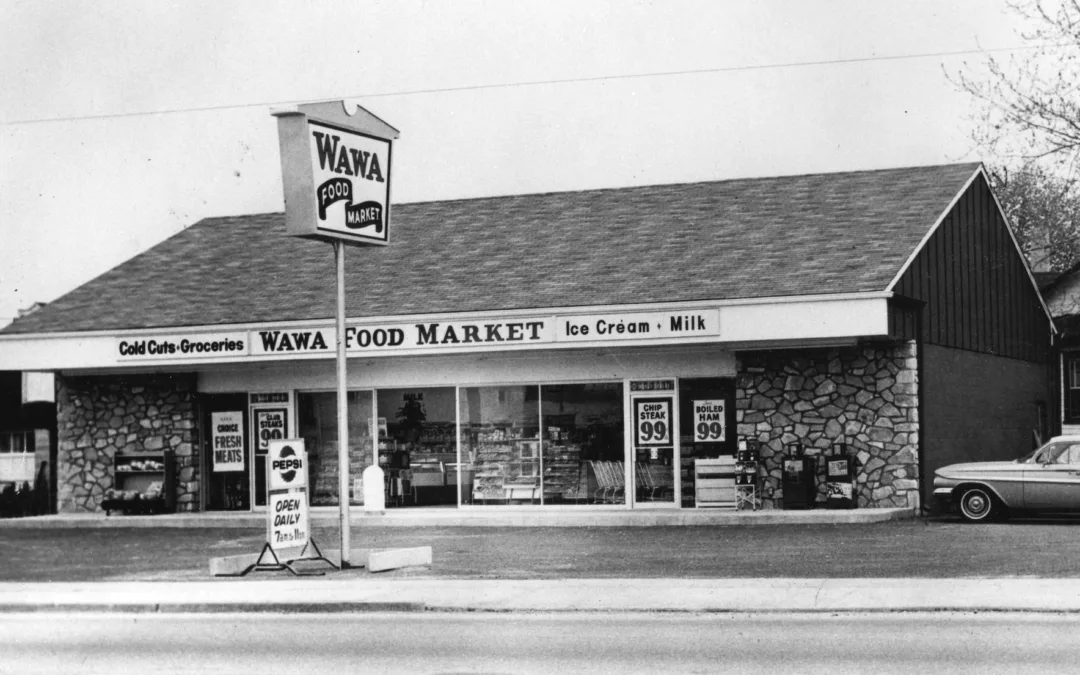

What do you know about Wawa? 7 fun facts about Pennsylvania’s beloved convenience store

Wawa has 60 years of Pennsylvania roots, and today the commonwealth’s largest private company has more than 1,000 locations along the east coast....

Conjoined twins from Berks County die at age 62

Conjoined twins Lori and George Schappell, who pursued separate careers, interests and relationships during lives that defied medical expectations,...