This photo from the Pennie 2023 annual report shows the Facebook page of the state-based insurance program. (Photo: USA Today Network)

Insurers providing coverage through Pennie, the commonwealth’s Obamacare marketplace, are looking to hike premiums by nearly one-fifth in the coming year as they grapple with rising costs, according to state officials.

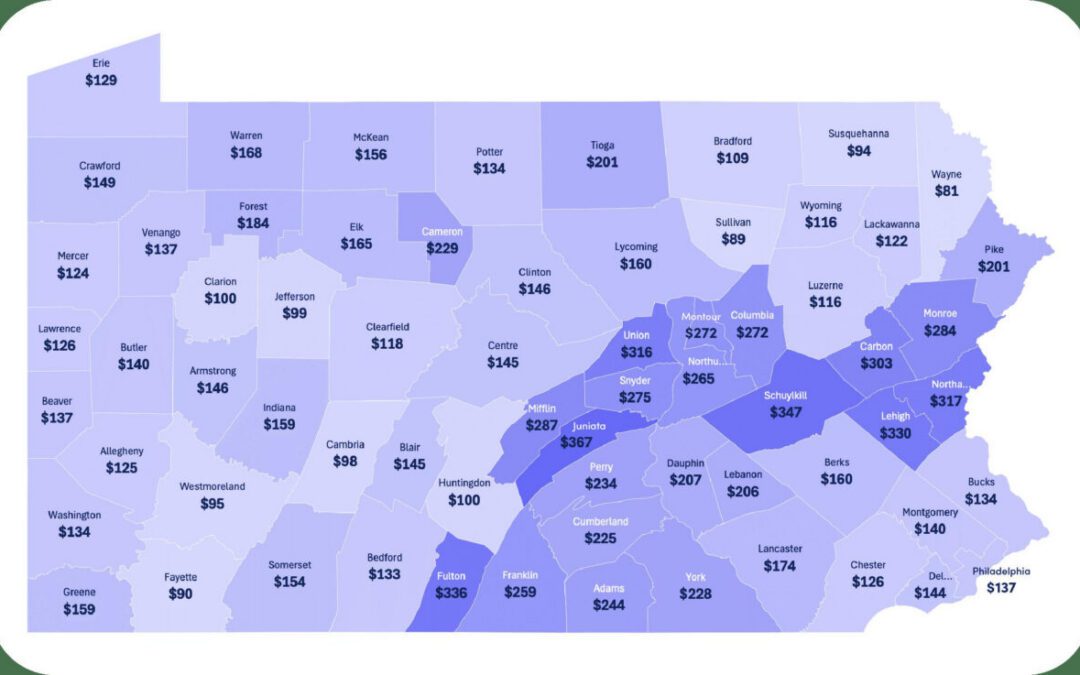

The Pennsylvania Insurance Department on Aug. 1 released a list of the rate increases requested by insurers for 2026. The companies want to push premiums up by an average of 19% for individual enrollees and by 13% for group plans used by small businesses, according to the state.

“This year, even more than previous years, Pennsylvanians should consider shopping around to find the best plans to meet their individual needs, at a price that makes sense for their current financial situation,” Michael Humphreys, Pennsylvania’s insurance commissioner, said in a statement.

The insurance department will look at the requested increases and evaluate them to make sure they’re not excessive or discriminatory. The agency was accepting public comment on the proposed rates through Sept. 2 and expects it will release the approved totals in October.

The proposed premium increase far outstrips those requested over the past two years, with the requested rate increases averaging out to 7.9% in 2024 and 4.2% in 2023.

The requested bump, state officials say, reflects the rising cost of health care, the expense of outpatient services, medication and other benefits and the expiration of federal tax credits for insurance premiums.

Congress has not extended the credits, which are due to end Dec. 31 and helped low-income Americans pay for health coverage through the Affordable Care Act. If the credits vanish, Pennie has estimated that 150,000 Pennsylvanians are at risk of losing ACA health coverage because they could no longer afford it.

Here are the proposed average rate changes by insurance plan for individuals:

- Ambetter Health of Pennsylvania Inc: 30.1%

- Capital Advantage Assurance Company: 26%

- Geisinger Health Plan: 14.1%

- Geisinger Quality Options: 16.2%

- Health Partners Plans “Jefferson Health Plans”: 7.3%

- Highmark Benefits Group Inc.: 18%

- Highmark Coverage Advantage Inc.: 14.1%

- Highmark Inc.: 17.2%

- Independence Blue Cross (QCC Ins. Co.): 16.7%

- Keystone Health Plan Central: 27.9%

- Keystone Health Plan East Inc.: 23.5%

- Oscar Health Plan of PA: 22%

- Partners Insurance Company Inc.: -10.1%

- UPMC Health Options Inc.: 11.7%

- UPMC Health Plan Inc.: 16.3%

One in 5 ACA enrollees in Pa. drops health coverage as costs spike

About 85,000 Pennsylvanians have dropped their Affordable Care Act coverage for 2026 in the face of soaring premium costs from the expiration of...

It’s 2026 and you’re uninsured. Now what?

It’s 2026, and you’re uninsured. Now what? Renuka Rayasam February 2, 2026 Health policy changes in Washington will ripple through the...

Two community hospitals in York County set to open this spring

Two new community hospitals in York County are expected to open in the spring, according to WellSpan's advertisements. One of the hospitals is just...

Report: Pa. hospitals face increasingly precarious financial future

Financial instability could force closures at more than a dozen Pennsylvania hospitals in the coming five years if state policymakers fail to act...

Pa. Pennie enrollment drops as Congress wrestles with health insurance subsidy vote

Some Pennsylvanians stay enrolled and pay tripled premiums with the hope lawmakers will vote to extend tax credits. Thousands of Pennsylvanians have...