Boyer's employee Emily Quinn stocks dairy items. At the Boyer's Food Markets grocery store in Womelsdorf on April 8, 2021. (Reading Eagle Photo via Getty Images/Ben Hasty)

Pennsylvanians are wringing their hands over the still-increasing costs of living while businesses, as a whole, are raking it in.

If you’ve ventured out of your home at all lately, you know prices are up everywhere. From the cost of hamburger meat at the grocery store to painfully high rates at the gas pump, Pennsylvanians are paying more out of pocket just to live their lives.

With an overall 8.1% inflation rate over the last year that’s at the highest levels seen in four decades, we’re all trying to figure out how to stretch our dollars. (Inflation describes the loss of purchasing power over time as prices go up.)

To no one’s surprise, however, the experience of working families and their quickly emptying wallets is vastly different from corporations, where bank accounts are filling up with record levels of profit.

American businesses’ pre-tax profits were up 25% over the last year, the best scenario corporate America has had since 1950, according to data from the US Commerce Department and Bloomberg News reporting.

Former US Labor Secretary Robert Reich testified in front of Congress earlier this month about what he says is causing the rise in prices for Americans: corporate greed by passing on the cost of inflation, and then some, to consumers.

The lack of competition in the business world has left people very few options but to fork over more money for essentials such as housing, cars, groceries, and gasoline, putting more pressure on the middle class and struggling families.

“They’re passing these costs on to consumers in the form of higher prices. Why? Because they can,” said Reich, according to Marketplace. “And they can because they don’t face meaningful competition. If markets were competitive, companies would keep their prices down to prevent competitors from grabbing away customers.”

Amazon, for example, announced recently that it will begin charging sellers who use the company’s fulfillment services a 5% fuel and inflation surcharge. This comes after the company increased its Prime annual membership fee by $20. Last year, Amazon’s net income doubled compared to the year before, from $7.2 billion to $14.3 billion in 2021.

The Biden administration attempted to address this lack of competition, with an executive order last year to give more power to workers to change jobs, limit fees Internet companies can charge for breaking contracts, make it easier to get airline flight refunds, and increase small business opportunities.

During his State of the Union address in March, President Joe Biden also called for American companies to bring production back to the United States and increase worker pay. His Build Back Better package—which remains stalled in Congress with zero support from Republicans—includes several provisions to bring down everyday costs for Americans, such as prescription drugs and child care.

Politics

Breaking down IVF: What it is and why it’s important in the fight for reproductive rights

In vitro fertilization, or IVF, has been at the forefront of a major reproductive rights battle, but what exactly is it? For many Americans, in...

Fetterman introduces bill to protect affordable internet access for 23 million households

The Affordable Connectivity Program expired on Tuesday due to Republican opposition, putting affordable high-speed internet access at risk for 23...

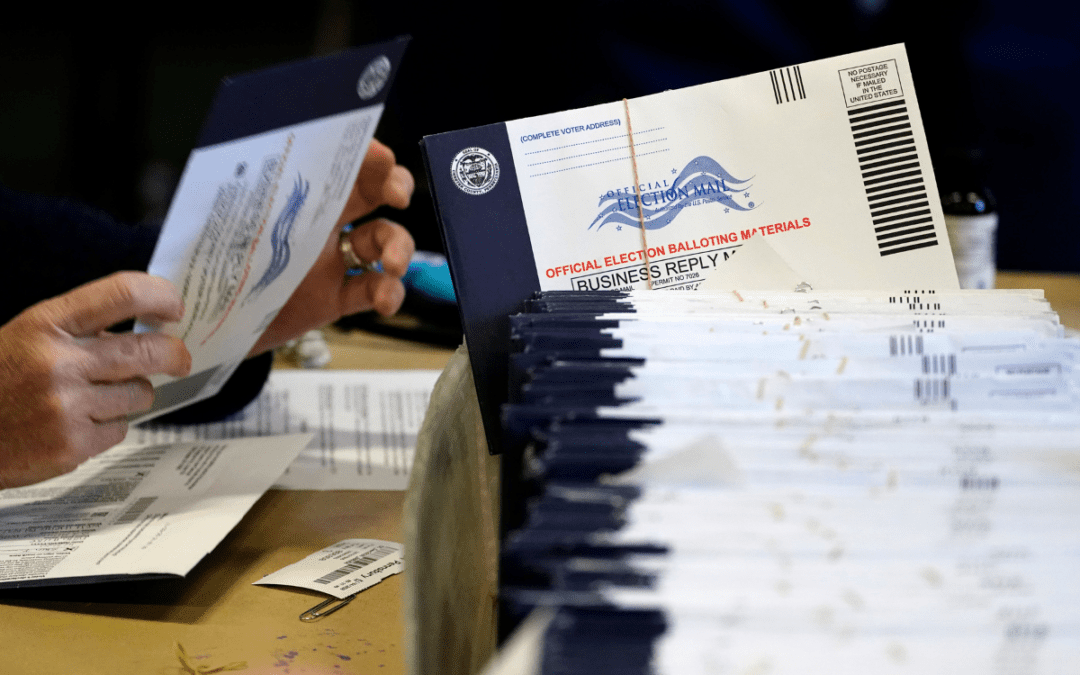

Democrats advance election bill in Pennsylvania long sought by counties to process ballots faster

HARRISBURG, Pa. (AP) — Pennsylvania's House of Representatives on Wednesday approved a bill long sought by counties seeking help to manage huge...

Local News

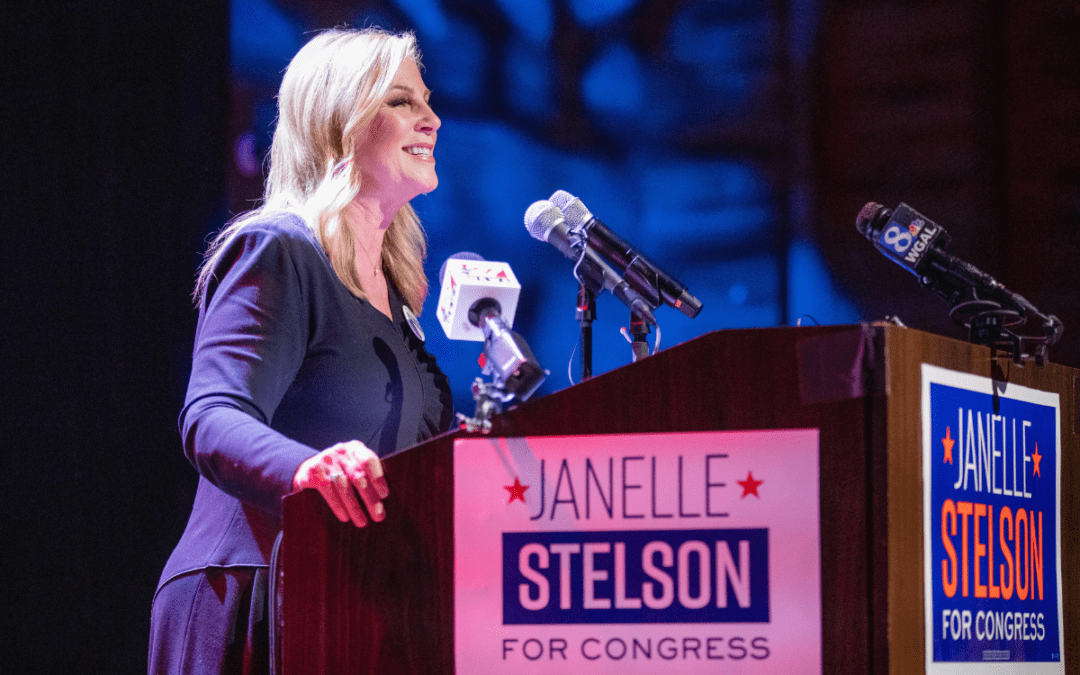

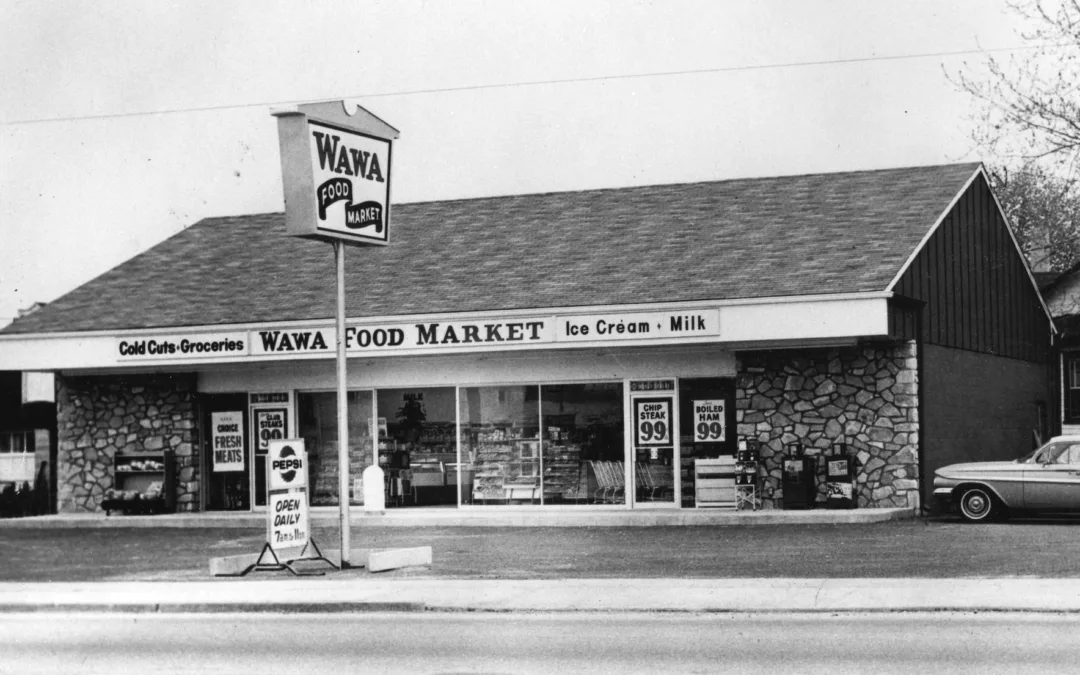

Look out, Sheetz, Wawa is officially moving into your territory with Central Pa. expansion

The Delaware County-based convenience store chain broke ground on its first Dauphin County location Wednesday in Middletown, with five more stores...

What do you know about Wawa? 7 fun facts about Pennsylvania’s beloved convenience store

Wawa has 60 years of Pennsylvania roots, and today the commonwealth’s largest private company has more than 1,000 locations along the east coast....