FILE—In this file photo from June 10, 2021, a flume of emissions flow from a stack at the Cheswick Generating Station, a coal-fired power plant, in Springdale, Pa. A plan to impose a price on carbon dioxide emissions from fossil fuel-fired power plants in Pennsylvania is going before the Independent Regulatory Review Commission, a five-member panel made up of three Democratic appointees and two Republican appointees on Wednesday, Sept. 1, 2021. (AP Photo/Keith Srakocic, File)

The bill lowers healthcare costs, incentivizes companies to adopt renewable energies and produce clean energy products; provides consumer rebates for those products, and delivers tens of billions of dollars of direct investments to American communities—funded by taxes on billion-dollar corporations.

Gas prices are down, jobs growth is up, and the Democratic-led government is on the verge of passing a once-in-a-generation bill to lower healthcare costs, fight climate change, and increase taxes on big corporations.

On Sunday, all 50 Senate Democrats—including Pennsylvania Sen. Bob Casey—voted to pass the Inflation Reduction Act of 2022, an impactful bill with a wide array of support from economists, climate experts, healthcare activists, and more.

“This historic legislation makes crucial investments in energy, health care, and in shoring up the nation’s tax system. These investments will fight inflation and lower costs for American families,” a group of 126 leading economists wrote in a letter to congressional leadership.

In fact, an independent analysis from Moody’s Analytics found that the bill would reduce inflation over the long run. “As named, the Inflation Reduction Act will lean against inflation over the next decade,” said Mark Zandi, chief economist at Moody’s.

Every single Senate Republican—including Pennsylvania Sen. Pat Toomey—voted against the bill, but because Democrats used a Senate procedure called budget reconciliation to pass the bill, it only required 50 votes plus Vice President Kamala Harris’ tie-breaker. The House of Representatives is expected to pass the vote later this week. If they do, it would then go to President Joe Biden’s desk for his signature.

Here’s what the Inflation Reduction Act would mean for Pennsylvania families:

Lower Healthcare and Prescription Drug Costs

The Inflation Reduction Act would extend generous subsidies that help make the Affordable Care Act more affordable. Those subsidies—introduced under Biden’s American Rescue Plan in 2021—are set to expire at the end of this year, but the Inflation Reduction Act would extend them through 2025.

If you’re one of the roughly 76,000 Pennsylvanians who has been able to afford health insurance from the Affordable Care Act (ACA) marketplace thanks to these subsidies, the Inflation Reduction Act means you get to keep your insurance. Without the extension of the subsidies, you’d be at risk of losing that coverage in 2023.

The extension of the subsidies also means that about 10 million Americans—including an estimated 270,000 Pennsylvania residents—who’ve had access to more affordable ACA insurance plans won’t have to suddenly pay more in 2023.

How critical are these subsidies? Well, since they were introduced, Pennsylvania households who received them have saved an average of $200 a month on premiums, according to Gov. Tom Wolf’s office.

The Inflation Reduction Act also reforms Medicare to lower drug costs for many of the more than 2.2 million Pennsylvania seniors with Medicare Part D coverage, which covers prescription drugs.

If you’re a Medicare recipient, here’s how the bill would benefit you:

- Beginning in 2023, all vaccines covered under Medicare Part D will be completely free.

- The bill will cap out-of-pocket spending on prescription drugs to $2,000 a year starting in 2025 for Pennsylvania residents with Medicare Part D prescription drug plans.

- It requires Medicare to negotiate the cost of 10 high-cost prescription drugs beginning in 2026, with additional drugs added in future years.

- The bill implements a $35 monthly cap on insulin for Medicare recipients.

More than 3.3 million Medicare beneficiaries nationwide rely on insulin, with the average patient spending $54 a month on prescriptions—an increase of nearly 40% in the past 15 years—according to the Kaiser Family Foundation. Some Medicare recipients spent over $100 a month on insulin, though, as certain brands charged higher prices than others.

Here in Pennsylvania, 1.1 million residents have been diagnosed with diabetes and rely on insulin.

According to the American Diabetes Association, the direct medical expenses for Pennsylvanians living with diabetes was $9.3 billion dollars in 2017, with another $3.5 billion spent on indirect costs from lost productivity due to diabetes.

Fighting Climate Change and Saving Pennsylvania Families Money on Energy

It’s been almost a year since Pennsylvania was walloped by the remnants of Hurricane Ida, which brought record-breaking rains, high winds, and even a few tornadoes to the state, leaving homes destroyed and areas flooded.

The reality is, climate change and the increase in extreme weather events are now an ever-worsening crisis that every country must fight against.

The Inflation Reduction Act represents America’s entry into that fight. Multiple independent analyses from climate and energy groups have found that the bill would create millions of jobs—potentially up to 9 million over the next decade—while reducing premature deaths from air pollution and helping the US dramatically reduce climate change-causing emissions.

The bill represents the largest-ever national investment in fighting climate change and would accelerate private companies’ transition to clean energy technologies, expand domestic manufacturing of clean energy products, and boost American energy independence to make the country less reliant on foreign oil—all while making renewable energy products a financial winner for Pennsylvania consumers.

Here’s how: The Inflation Reduction Act extends and adopts hundreds of billions of dollars in new tax credits to incentivize industries and utilities toward solar, wind, hydropower, and nuclear power. Manufacturers could get subsidies for building electric vehicles (EVs) and renewable energy products, while utilities could get credits for choosing solar and wind energy over fossil fuel plants.

Crucially, the bill also delivers $80 billion in financial rebates for households to adopt those clean energy products, such as EVs, solar panels, and more efficient heat pumps. Here’s how some of those rebates would work:

Anyone who earns less than $150,000 a year as an individual (or $300,000 as a couple) and wants to buy a new EV would get a $7,500 tax credit applied at the point of sale. If eligible Pennsylvanians prefer to buy a used electric vehicle, they would get $4,000 off at the point of sale.

This investment in electric vehicles follows the government’s massive effort to build out charging infrastructure via 2021’s Infrastructure Law, which saw the Biden administration and a Democratic-led Congress invest billions of dollars in electric charging stations. Accelerating a transition to EVs will not only reduce emissions but also save consumers money, as operating an electric car is substantially cheaper than driving cars that rely on gas.

The bill also directs billions of dollars to state energy offices and will help roughly 1 million middle- and low-income households in the US go electric with the help of direct rebates up to $14,000.

If this applies to you, you could receive the following amounts in rebates:

- $8,000 for a heat pump for space heating

- $4,000 for an upgraded breaker box

- $2,500 for upgraded electric wiring

- $1,750 for a heat pump water heater

- $1,600 for insulation, air sealing, and ventilation

- $840 for an electric stove, cooktop range, or oven

- $840 for an electric clothes dryer

Other households that upgrade with some of these technologies can deduct up to 30% of the total cost from their taxes, with deductions limited to $600 per upgrade and up to $1,200 per household per year. The only exception is that households can deduct 30% of the costs for buying and installing a heat pump water heater or heat pump for their space heating and cooling, up to $2,000.

The bill also reauthorizes an existing program that allows households to receive a 30% credit on home solar panel installations until 2032.

If customers claim all the subsidies offered in the bill, they could save more than $1,800 on their annual energy bill on average, according to an analysis by Rewiring America, a climate analysis group.

The bill also provides $20 billion to help farmers and ranchers adopt practices to increase their land’s resilience to climate change; allocates nearly $10 billion for rural electricity cooperatives; establishes funding for more than $40 billion in clean energy loans; provides crucial funding for forest management to support wildfire risk-reducing activities; gives subsidies to developers to build energy efficient homes and businesses to transition to clean energy; rewards oil and gas companies that slash methane emissions and penalizes those that don’t; and invests in Tribal and other disadvantaged communities to help reduce greenhouse gas emissions and transition to clean energy systems.

The bill does require new oil and gas lease sales in the Gulf of Mexico and off the coast of Alaska–concessions necessary to win the vote of Democratic Sen. Joe Manchin, who views drilling in those areas as critical for the nation’s energy independence.

Climate experts have criticized that measure but argue the bill’s other climate provisions more than make up for the new leases and are critical to cutting the emissions that drive climate change.

Raising Taxes on Corporations and Reducing the Deficit

The Inflation Reduction Act does not raise taxes on small businesses or Americans earning under $400,000 a year. In fact, it funds its healthcare and climate measures primarily by raising taxes on large corporations.

The largest tax hike in the plan would apply to all American corporations that earn more than $1 billion per year in profits. Under existing law, US companies are supposed to pay a 21% corporate tax rate, but many billion-dollar companies exploit the tax system and claim deductions and other tax credits, ultimately paying nothing in federal income taxes.

The Inflation Reduction Act aims to address that problem by implementing a minimum tax of 15% on most large corporations. Some companies would still be able to claim tax credits and would be allowed to deduct certain investment expenses, and firms owned by private equity would be exempted, but the new tax is expected to raise hundreds of billions of dollars in funds.

The bill also implements a 1% tax on stock buybacks, which is what happens when companies purchase shares of their own stocks—moves that often enrich already-wealthy shareholders by driving up the value of the stock.

Lastly, the bill accomplishes all this while reducing the federal deficit by $300 billion, a key Biden administration goal.

Politics

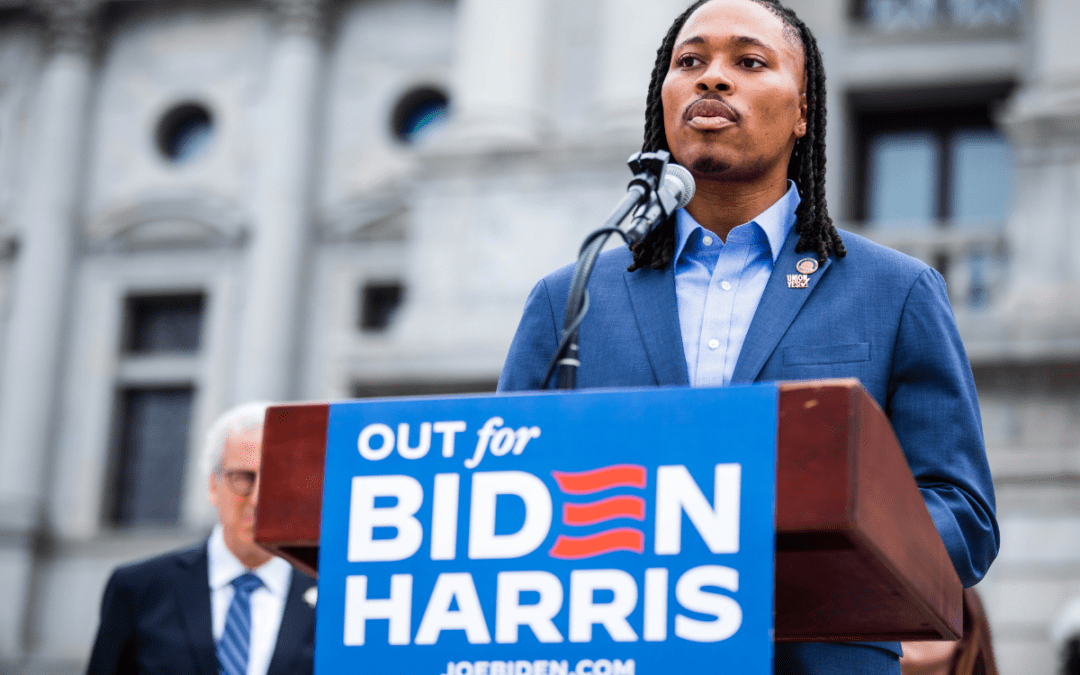

Malcolm Kenyatta makes history after winning primary for Pa. Auditor General

State Rep. Malcolm Kenyatta, who was first elected to the state House in 2018, won the Democratic nomination for Pa. Auditor General and will...

Biden administration bans noncompete clauses for workers

The Federal Trade Commission (FTC) voted on Tuesday to ban noncompete agreements—those pesky clauses that employers often force their workers to...

Philadelphia DA cancels arrest warrant for state Rep. Kevin Boyle on eve of Pa. primary

Philadelphia District Attorney Larry Krasner said a detective had sought the warrant against Boyle, a Democrat whose district includes a section of...

Local News

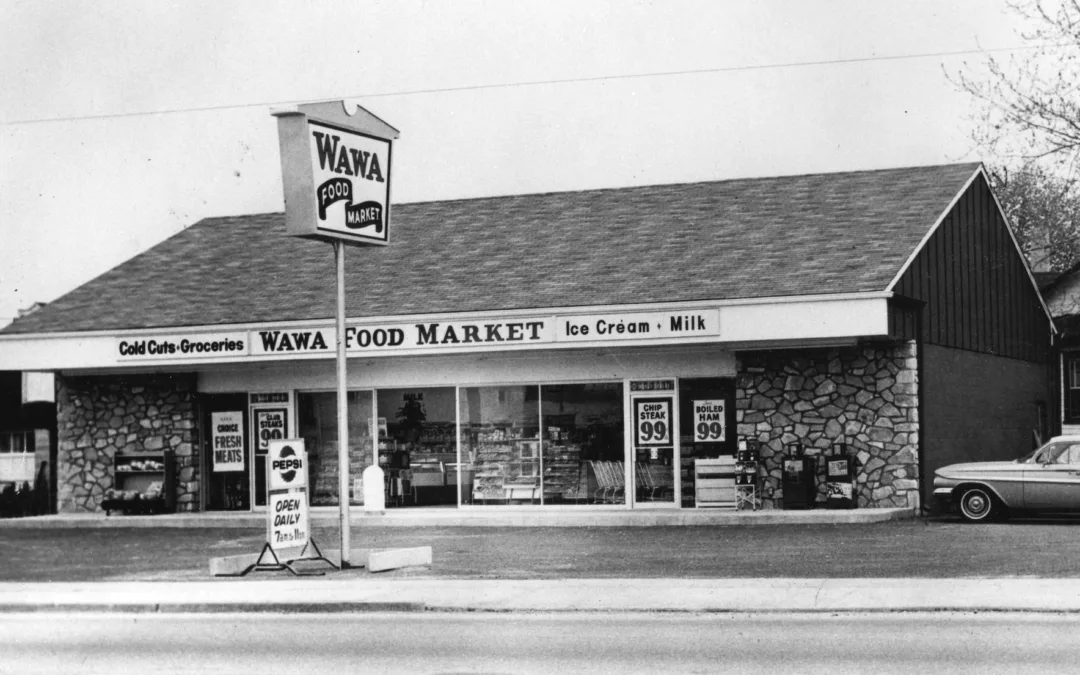

What do you know about Wawa? 7 fun facts about Pennsylvania’s beloved convenience store

Wawa has 60 years of Pennsylvania roots, and today the commonwealth’s largest private company has more than 1,000 locations along the east coast....

Conjoined twins from Berks County die at age 62

Conjoined twins Lori and George Schappell, who pursued separate careers, interests and relationships during lives that defied medical expectations,...