FILE - Mehmet Oz takes part in a forum for Republican candidates for U.S. Senate in Pennsylvania at the Pennsylvania Leadership Conference in Camp Hill, Pa., April 2, 2022. Millionaire candidates and billionaire investors are harnessing their considerable personal wealth to try to win competitive Republican primaries for open U.S. Senate seats in Pennsylvania and Ohio. In Pennsylvania, three multimillionaire candidates, including TV's Dr. Mehmet Oz, report loaning their campaigns over $20 million combined. (AP Photo/Matt Rourke, File)

The Republican US Senate candidate’s Montgomery County home qualifies for a controversial state program that offers tax break incentives to wealthy homeowners for not developing farm or forestland.

WIth the purchase of a farmhouse in Montgomery County, Dr. Mehmet Oz not only “established” his residency in Pennsylvania, he also got a $50,000 tax break.

A report from the Philadelphia Inquirer details how Pennsylvania’s Republican nominee for US Senate and celebrity doctor purchased the property for $3.1 million in December 2021 — weeks after he launched his Senate campaign — and the tax break he receives on the forested, 34-acre property in Lower Moreland Township, which features a 7,300-square-foot, eight-bedroom manor house.

Oz’s use of the tax incentive is totally legal and was in place decades before he purchased the property, which formerly belonged to a church his in-laws are a part of. The incentive is part of a controversial state program designed to encourage the preservation of farm or forestland that overwhelmingly benefits wealthy landowners.

According to the story, Oz is not currently living in the home and says he’s simply awaiting renovations before he moves in. But the Inquirer reports that there’s little sign of work at the property, and he continues to live at his in-laws’ home in nearby Bryn Athyn.

By purchasing the home, Oz was probably hoping to silence the naysayers regarding his Pennsylvania residency status. And while he may yet achieve that goal, the optics of receiving a $50,000 tax break on a home he paid $3.1 million for has given his opponent, John Fetterman, even more fodder for social media.

“I inherited it,” Oz said in an interview with the Philadelphia Inquirer about the tax incentive. “And I intend to preserve that land and not do anything that would hurt it.”

According to county records, the property has benefited from the Pennsylvania Department of Agriculture’s “Clean and Green” tax incentive for over 30 years. The program is part of a wider initiative that encourages property owners to save land from development by entitling them to a more favorable property tax assessment. There are no income restrictions on the program, which has also been granted to about 140 other property owners across Montgomery County.

While Oz said he did not seek out a tax break, he did file a transfer application to continue receiving the perk, according to records.

In Oz’s reapplication, dated March 2022, he attested that the entirety of the woodsy acreage would continue to be held as a “forest reserve” while under his ownership. In exchange, Oz saw more than $1 million dollars knocked off the $1.52 million assessed value of the property. That means the county considers a sprawling tract of land Oz paid millions to purchase to be worth just $447,930 for tax purposes — or just slightly above the median listing price for a home in Montgomery County.

Politics

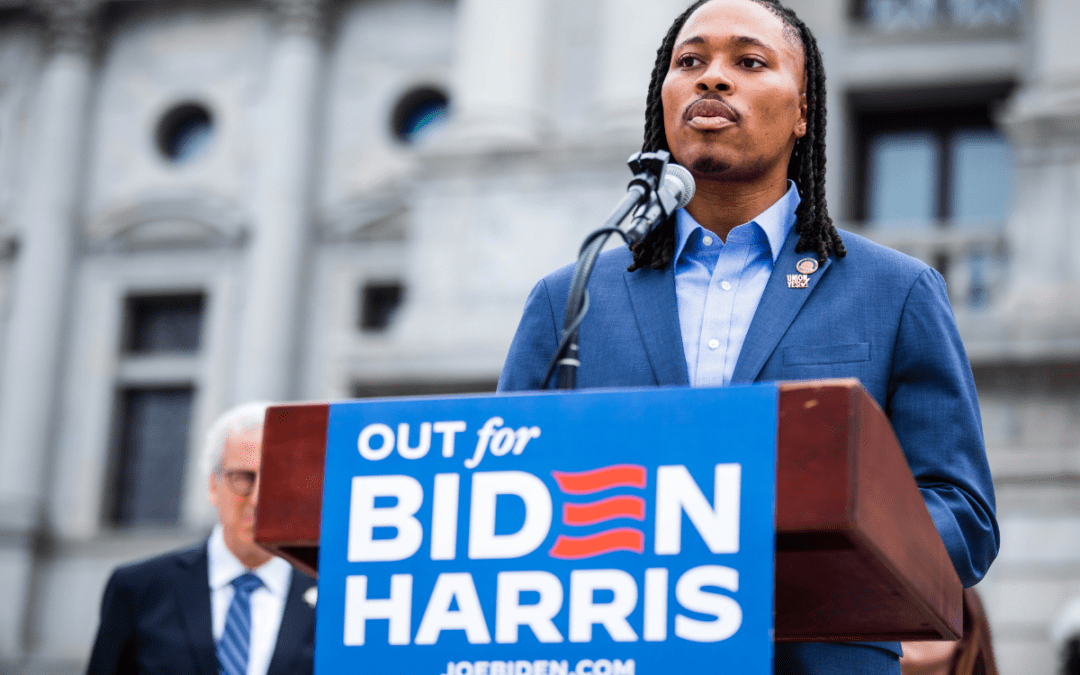

Malcolm Kenyatta makes history after winning primary for Pa. Auditor General

State Rep. Malcolm Kenyatta, who was first elected to the state House in 2018, won the Democratic nomination for Pa. Auditor General and will...

Biden administration bans noncompete clauses for workers

The Federal Trade Commission (FTC) voted on Tuesday to ban noncompete agreements—those pesky clauses that employers often force their workers to...

Philadelphia DA cancels arrest warrant for state Rep. Kevin Boyle on eve of Pa. primary

Philadelphia District Attorney Larry Krasner said a detective had sought the warrant against Boyle, a Democrat whose district includes a section of...

Local News

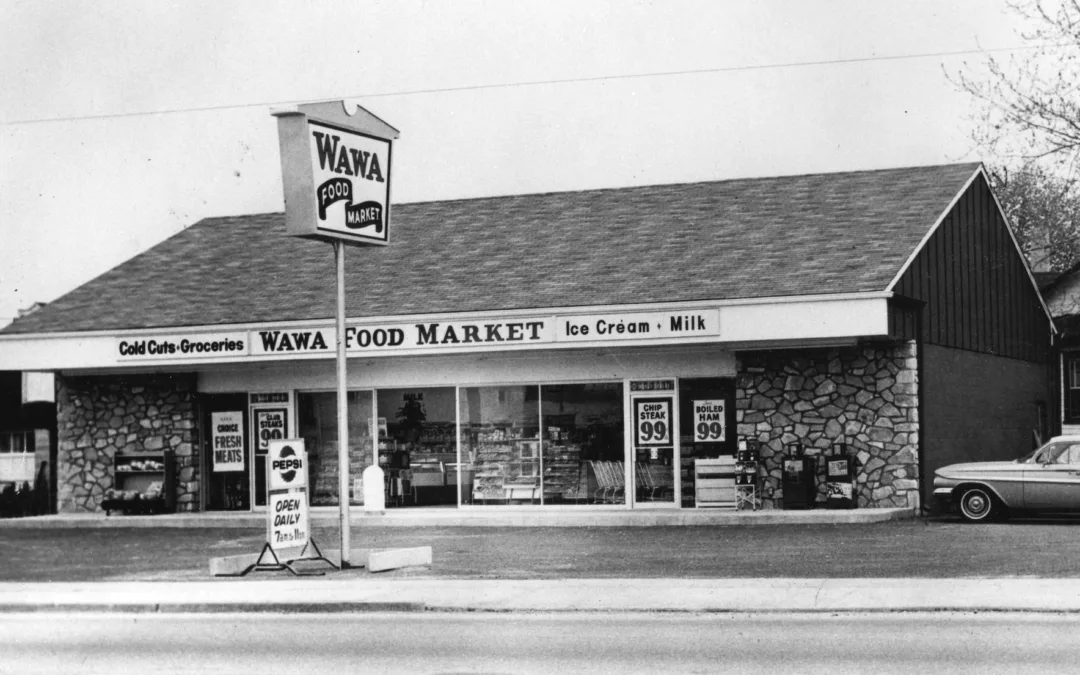

What do you know about Wawa? 7 fun facts about Pennsylvania’s beloved convenience store

Wawa has 60 years of Pennsylvania roots, and today the commonwealth’s largest private company has more than 1,000 locations along the east coast....

Conjoined twins from Berks County die at age 62

Conjoined twins Lori and George Schappell, who pursued separate careers, interests and relationships during lives that defied medical expectations,...